Is Service Revenue an Asset?Explained with Journey Entry Examples

When you successfully render or perform a service, you expect that you’ll be paid.

Well, that is unless you’re doing it for charity.

But anyway, if you’re running a business that offers services, you’d expect that you’d get paid for the services you do.

Otherwise, why make a business out of it right?

For example, you run a salon that offers a wide array of beauty treatments.

For every successful beauty treatment that your salon delivers, you expect your happy clients to pay.

Otherwise, how are you going to pay your beauticians?

How about the rent for the space that your salon is occupying?

The interest for the loan you applied for so you can start your salon business?

Why start a business at all if you’re not gonna profit from it right?

Now, there are cases when you receive payment right after you complete a service activity.

There are also cases where payment is received days after the completion of service (if the business allows it).

Also, payment can be received even before service is rendered or performed.

Either way, you’ll get paid (one way or another) for the services that you offer.

Whenever you successfully render service, it is recorded in your books as service revenue.

From a previous article I wrote, we learn that service revenue refers to revenue earned from the sale of services.

And whenever your business earns service revenue, its value increases either by receiving cash or accumulating accounts receivable.

So the question now is, since service revenue increases your total assets whenever your earn it, is it considered an asset?

Before we can answer this question though, we must review what service revenue is, as well as what an asset is.

What is service revenue?

When you successfully render or perform a service, the revenue you earn from it is what we refer to as service revenue.

Service revenue is recorded in your books whenever it is earned regardless of whether payment is received or not.

For example, imagine that you own a business that solely offers cleaning services.

A client contracted your business to offer cleaning services on a certain day.

You both agreed that you’ll get paid $150 on the day you perform your cleaning services.

The $150 that you’ll earn after you complete the cleaning service is a service revenue.

This is because the $150 earned essentially came from the sale of a service.

Service revenue is an important metric for any business that offers services.

Even more for businesses that exclusively offer services. It shows how profitable the service or services a business offers are.

It is a key performance indicator that can help you assess your business’s profitability and financial health.

Service revenue contributes to the total revenue that a business earns.

If a business offers both goods and services, then its total revenue will consist of product revenue and service revenue.

If it only offers service revenue, then its total revenue will entirely consist of service revenue.

What is an asset?

An asset, as defined by the IASB (internal accounting standards board) is:

“An asset is a resource controlled by the entity as a result of past events and from which future economic benefits are expected to flow to the entity.”

From the definition above, we can gather that an asset is a property that a business or individual owns or controls.

For example, the cash that your business owns is one of its assets.

In short, assets are what bring in the money to the business.

An asset can either be tangible or intangible.

A tangible asset has a physical form.

For example, cash, machinery, and equipment all have physical forms, and as such, they are what we call tangible assets.

An intangible asset does not have a physical form.

An example of an intangible asset is the accounting software you use for your business.

Assets are typically presented in a business’s balance sheet.

They are divided into two categories: current assets and non-current assets.

Current assets are assets that can be reliably converted into cash within a year.

Current assets also include assets that are expected to be consumed within a year.

Examples of current assets are cash, accounts receivable, inventory, and prepaid expenses.

Non-current assets are assets that cannot be readily converted to cash.

They are expected to provide economic benefits for more than one accounting period or year.

Examples of non-current assets are properties such as building, land, machinery, and equipment.

Is service revenue an asset?

So now that we’ve reviewed what service revenue is as well as what an asset is, we can finally address the question “Is service revenue an asset?”.

Well, the short answer is no.

Service revenue is not an asset… in regards to accounting that is.

Service revenue appears in an income statement, not in a balance sheet

One of the characteristics of an asset is that it appears in a business balance sheet.

You’ll be hard-pressed to find a balance sheet that lists a business’s service revenue.

That’s because you typically won’t find one.

Service revenue is an income statement account and as such, would typically appear in a business’s income statement.

From this alone, we can conclude that service revenue is not an asset.

Service revenue normally has a credit balance

Another characteristic of an asset that cannot be found on service revenue is that it normally has a debit balance.

Meaning that when you acquire an asset, it will be recorded in the books as a debit balance.

Service revenue, on the other hand, normally has a credit balance.

When you earn service revenue, you record it in the books as a credit balance.

Service revenue is not an asset, though it does contribute to the accumulation of assets

So yeah, service revenue is not an asset.

Rather, it is a revenue account.

The confusion is understandable though as when you earn service revenue, your total assets also increase.

For example, when you perform a service, you either earn cash or a promise to be paid at a later date (accounts receivable).

What we can gather from this is that service revenue itself is not an asset, but it does contribute to the accumulation of assets.

Recording service revenue in your books

Recording service revenue is just like recording any other type of revenue: you only record service revenue when you earn it.

The question now is, when is service revenue earned?

And the answer to that question is: it depends.

Commonly, service revenue is earned when service is fully rendered or performed.

For example, a barbershop earns service revenue when a barber finishes cutting a customer’s hair.

A laundry shop earns service revenue when it completes a laundry service.

A salon earns service revenue when it completes a beauty treatment.

Service revenue can also be earned according to the percentage of completion.

For example, if a project is 25% complete, then you earn 25% of the service revenue that you expect to earn from the project.

This method of recognizing service revenue is typically used for services that span over several periods.

For example, construction services can last for more than a year depending on the scale of the project.

Thus, a business that does construction services records service revenue based on the percentage of completion.

When service revenue is earned, you record it in your books as a credit entry.

The corresponding debit entry will depend on whether you receive payment at the date when you earned service revenue or at later date instead.

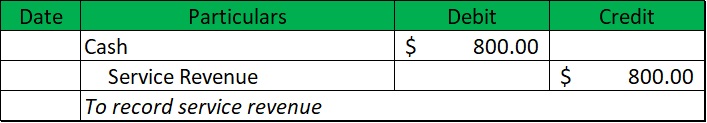

When you receive cash at the time you earned service revenue, the journal entry will be:

When you receive a promise of payment at a later date (accounts receivable) instead, the journal entry will be:

In the case of advance payment, do I record service revenue outright?

When you receive payment for a service that still has to be rendered or performed, you do not record service revenue yet (assuming you employ the accrual accounting method).

Rather, you record “unearned revenue” as your credit entry.

Unearned revenue is a liability account as it represents an obligation to render or perform service for the payment that you already received.

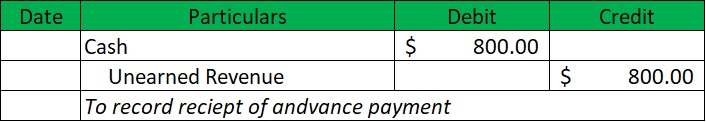

As an example, let’s say that you own a business that does repairs and maintenance of machinery.

A customer contracted you to perform repairs and maintenance on their machinery.

You both agreed that the whole service will cost $800.

The customer paid you upfront.

Upon the receipt of the $800 upfront payment, you need to record unearned revenue as you still have to perform the repairs and maintenance services.

The journal entry should look like this:

When you finally perform repairs and maintenance services and complete them, that’s the time when you record service revenue. The journal entry will then be:

You record service revenue as you already earned it when you perform repairs and maintenance on the customer’s machinery.

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

Cornell Law School "Accounts Receivable" Page 1 . December 21, 2021

Germanna Community College "Chart of Accounts" Page 1 - 6. December 21, 2021