Cost Volume Profit (CVP) Analysis in Business

Cost-volume-profit (CVP) analysis is used to determine how changes in costs and volume affect a company’s operating income and net income.

Another term for Cost Volume Profit (CVP) Analysis is breakeven analysis.

This method of cost accounting is used to look at the breakeven point or in other words, the number of units that need to be sold in order to break even and cover fixed costs.

What is Cost Volume Profit Analysis Formula?

This formula finds the company’s targeted sales volume, which gives you the ability to find your breakeven sales volume, or breakeven point.

Here is the Cost Volume Profit Analysis Formula:

In order for this to work, you will first need to calculate your contribution margin as follows:

Contribution margin = Sales – Variable costs

The contribution margin can be calculated as a total of sales or as the selling price per unit.

Calculating the contribution margin as the price per unit would represent the incremental money generated for each product/unit sold after deducting variable costs.

A business cannot be profitable if the contribution margin does not exceed total fixed costs.

If the contribution margin is less than fixed costs, that means the company is not making any profit on their products.

In other words, it means that the selling price range of a product is less than what it takes to produce the product.

To calculate the breakeven sales volume, you need to first find the contribution margin and then divide fixed costs by contribution margin.

The contribution margin is the amount of sales dollars available to cover fixed costs.

For example, Company XYZ manufactures skateboards and they sell each skateboard for $30.00, but their cost to make the skateboard is $45.00.

If we use the contribution margin formula:

Contribution margin = Sales – Variable costs

$30.00 – $45.00 = -$15.00

This is telling us that they are actually losing $15.00 every time they produce a skateboard and are not even breaking even on their per unit production.

Now let’s say it costs them $30.00 to make a skateboard, but their costs are only $15.00 per unit:

Contribution margin = Sales – Variable costs

$30.00 – $15.00 = $15.00

This is telling us that they are profiting $15.00 per skateboard sold.

Now that we know how to calculate contribution margin, we can calculate the breakeven sales volume.

In order for the breakeven sales volume formula to be accurate, there are several assumptions made as follows:

- That the sale price per unit is constant

- That the variable costs per unit are constant

- That the total fixed costs are constant

- That all production is sold

- Costs are only effected if activity changes

- All products (even if the company sells more than one type) are sold in the same mix.

Let’s put it all together with an example using XYZ Company.

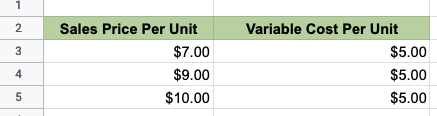

Here are some products that XYZ Company produces.

The data shows the Sales Price per unit as well as the Variable Cost per unit:

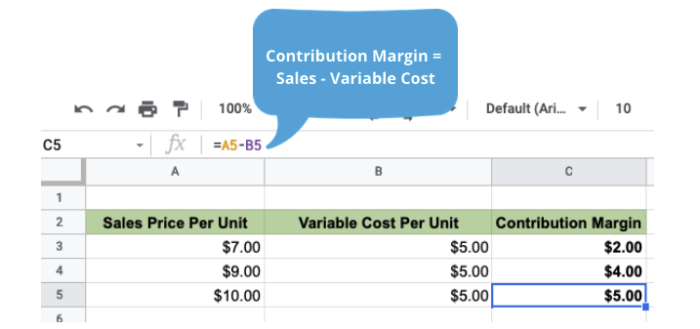

Let’s first calculate the contribution margin of each unit:

Contribution margin = Sales – Variable costs

$7.00 – $5.00 = $2.00 contribution margin

$9.00 – $5.00 = $4.00 contribution margin

$10.00 – $5.00 = $5.00 contribution margin

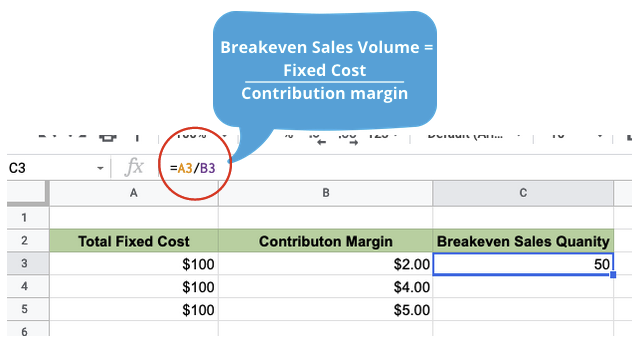

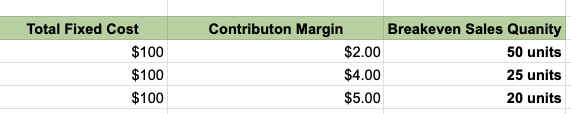

Now that we know our contribution margins for each item, we can calculate the breakeven sales volume:

This tells us that in order to breakeven and cover our fixed costs, we need to produce at least 50 Units for the first product, 25 units for the second product, and 20 units for the third product:

This formula is a powerful tool for managers when making production business decisions.

You would not want to sell a product that does not at least cover your fixed costs.

This formula also tells you the number of units that need to be sold or the amount of revenue needed to cover the costs of production.

It helps managers justify products and decide which ones are most profitable and perhaps which ones are not producing.

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

University of Albany "Cost-Volume-Profit" Page 1 . October 20, 2021

University of Baltimore " Break-Even Analysis and Forecasting" Page 1 . October 20, 2021