Conversion CostDefined with Examples & More

Producing goods requires more than just the actual materials.

To convert raw materials into a sellable product, you need the involvement of people (direct labor) and other things such as machinery and equipment (manufacturing overhead).

Even if you fully automate your production process, there’s still the involvement of machinery and equipment.

Indeed, raw materials don’t convert themselves into finished goods on their own.

You have to incur certain costs to convert them and we refer to these costs as conversion costs.

For example, the raw materials for bread, which are typically eggs, flour, and yeast, don’t convert into bread on their own.

It needs the involvement of someone to prepare the dough (direct labor), typically a baker.

Then after the dough is prepared, it would need the involvement of an oven to cook it.

So to convert eggs, flour, and yeast into bread, you’d at least have to incur the cost of hiring someone to prepare the dough as well as the cost of using an oven.

These are the conversion costs of making bread.

Tracking your business’s conversion cost will help in assessing its efficiency of producing sellable products from raw materials.

You’d also want to avoid incurring unnecessary costs, and knowing which costs are necessary for the conversion of your raw materials will help you with that.

The fewer the costs you incur, the higher your profits will be.

In this article, we will be discussing what conversion costs are.

We will also be discussing some examples of conversion costs that a business typically incurs.

Finally, we will be doing some exercises to deepen our understanding of conversion costs.

Conversion Cost: What is it?

A conversion cost is a type of cost that a business incurs in the process of converting raw materials into sellable goods.

This typically includes the cost of direct labor and manufacturing overhead (e.g. indirect materials, utility costs, depreciation, etc.).

These costs are necessary to convert raw materials into a product that the business can sell to its customers.

Here are some examples of conversion costs that businesses typically incur:

- The salaries and wages of employees who are directly involved in the production of goods (direct labor)

- The salaries and wages of factory supervisors and managers (indirect labor)

- Cost of renting the space that houses the manufacturing function of the business

- Depreciation of the machinery and equipment used in the production of goods

- Repair and maintenance expenses of machinery and equipment

- Cost of utilities to perform the manufacturing function of the business

- Factory supplies such as oil and lubricants

- Insurance costs related to the manufacturing function, such as factory insurance

Being aware of your business’s conversion costs helps in the assessment of its efficiency in converting raw materials into sellable goods.

As a business owner, you’d want to make sure that whatever you’re spending on ultimately contributes to the generation of revenue.

Meaning that you want to eliminate unnecessary expenses as much as possible.

Knowing your business’s conversion costs can help you with that.

Knowledge about conversion costs also helps managers and supervisors in tracking the cost of production.

It can help them in assessing whether the business is still spending the right amount or is already going over budget.

Conversion costs, along with the cost of raw materials, are a good basis for product pricing.

Ideally, a business would want to price its products in a way that covers all of the costs of production, which include conversion costs.

Calculating Conversion Costs

Calculating your business’s conversion costs is straightforward.

You only need to add up all of the components that make up your business’s conversions costs: direct labor and manufacturing overhead.

Put into formula form, it should look like this:

Conversion Costs = Direct Labor + Manufacturing Overhead

If you’re unsure whether an expense is a conversion cost or not, ask yourself this question: “Is this expense necessary for the conversion of raw materials into finished goods?”.

If the answer is yes, it’s probably a conversion cost.

There are mainly two components to a business’s conversion costs: direct and indirect costs.

First is the cost of direct labor.

This refers to all forms of compensation that the business pays its employees who are directly involved in the production of goods.

This includes the salaries and wages of said employees, as well as other forms of compensation such as payroll taxes and employee bonuses.

Manufacturing overhead, on the other hand, refers to expenses that are not directly traceable to any single product.

However, they are still necessary for the manufacturing of goods.

You can say that they are expenses that are directly relatable to the manufacturing function.

Examples include the cost of renting the space that houses the manufacturing function.

The production of goods is typically done within a factory.

If the business does not own the factory building, then it’s probably renting the building.

In this case, renting the building is necessary so that the business can perform its manufacturing function.

Any business that produces goods will incur conversion costs.

It doesn’t have to be a factory or manufacturing setting.

For example, a small bakery will incur conversion costs in making its main product, which is bread.

Conversion Costs vs Prime Costs

Prime costs refer to expenses that are directly attributable to a product.

This includes the cost of direct materials (raw materials), direct labor, and other expenses that are directly traceable to the manufacturing of a product.

On the other hand, conversion costs refer to expenses that are necessary for the conversion of raw materials into goods that the business can sell.

They don’t have to be directly traceable to a certain product.

The formula for the computation of prime costs is as follows:

Prime Costs = Direct Materials + Direct Labor

These two are often the only components of prime costs.

However, if there are other expenses that are directly attributable to a product, then include them in the formula.

Both prime costs and conversion costs refer to costs that a business incurs during the production of goods.

They just differ in which costs they include (though both include the cost of direct labor).

Prime costs mainly focus on the efficiency of direct costs.

It’s mainly useful for setting the appropriate price of a product.

On the other hand, conversion costs mainly focus on manufacturing efficiency.

Being aware of them helps in reducing unnecessary expenses, which improves the overall efficiency of the business’s manufacturing function.

Conversion Costs: Exercises

Exercise#1

Company A is a business that manufactures the products that it sells.

The following data were gathered regarding some costs that the business incurred, some of which were incurred during the manufacturing process:

- The cost of direct materials used in the production of goods amounts to $51,200

- Total direct labor amounts to $73,400

- Salaries and wages of administrative staff amount to $48,210

- As per computation, total manufacturing overhead amounts to $229,110

- Real property taxes for the office building that houses the administrative function amounts to $2,120

- Total sales commission amounts to $23,690

- Salaries and wages of sales staff amount to $33,420

Your task is the compute company A’s total conversion costs.

A lot of cost data were gathered above, but not all of them count as conversion costs.

To determine whether a cost is a conversion, it must be necessary for the conversion of raw materials into sellable goods.

We can also refer to the formula for the computation of conversion costs:

Conversion Costs = Direct Labor + Manufacturing Overhead

This means that only the following costs make up company A’s conversion costs:

- Direct labor of $73,400

- Total manufacturing overhead of $229,110

Now that we have the information we need, we can compute company A’s total conversion costs:

Conversion Costs = Direct Labor + Manufacturing Overhead

= $73,400 + $229,110

= $302,510

As per computation, company A’s total conversion costs amount to $302,510.

Exercise#2

The following are some of the expenses that a business will incur.

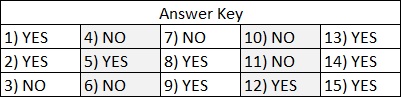

Your task is to identify whether the expense is a conversion cost or not.

Answer YES if it is.

Otherwise, answer NO.

- The salaries and wages of factory supervisors and managers

- Wages of janitorial staff assigned to maintain the factory building

- Rent for the building that house the business’s administrative function

- The cost of sales commission for every sale made by the business

- The salaries and wages of personnel directly involved in the manufacturing of goods

- Cost of raw materials used in the manufacturing of goods

- Total purchases of raw materials

- Cost of factory supplies such as oil, glue, and lubricants that were consumed during the manufacturing process

- Utilities and maintenance expenses of the building that houses the manufacturing function

- Utilities and maintenance expenses of the building that houses the administrative and sales function

- Cost of eggs and flour used for the making of bread

- Salary of the baker who makes bread

- Depreciation of machinery and equipment used in the manufacturing of goods

- Factory insurance

- Rent for the building that house the business’s manufacturing function

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

University of Michigan "Assessing The Costs of Conversion" Page 1 . March 1, 2022

Harper College "MANAGERIAL ACCOUNTING" Page 1 . March 1, 2022

Tallahassee Community College "Equations for Income Statements and Cost Concepts" Page 1 . March 1, 2022