Budgeted Income StatementDefined along with Examples

So you successfully formed your business.

Good for you! It’s now time to do the work and earn that well-deserved profit.

Sounds easy right? Well, just like most things, it’s easier said than done.

Profits don’t automatically come to your doorstep just because you have your business.

Rather, you need to earn it. Also, you need to plan for it.

Even already established businesses need to prepare their budgeted income statements when they’re setting their financial goals.

Indeed, budgeting, if used properly, can be a powerful tool that can help steer your business in the right direction.

It helps in creating financial plans that you can use as a guide for your business’s profits and losses for a certain period.

The budgeted income statement, in particular, is a useful tool that can help a business in predicting and planning its future profits.

It also helps in determining whether or not a business plan is feasible.

Unlike an actual income statement which is a recording of a business’s past or current performance, the budgeted income statement “predicts” a business’s future performance.

In this article, we will discuss what a budgeted income statement is and how it can be useful for you and your business.

We will also be looking into how one prepares it via an example. Let’s get to it then!

What is a Budgeted Income Statement?

A budgeted income statement (a.k.a. budget income statement or pro forma income statement) is a document that presents a business’s future financial performance according to certain factors.

It contains all of the line items that you can find on a normal income statement such as revenue, cost of sales, operating expenses, etc.

The difference is that it’s a projection of what the business’s financial performance would be like.

So instead of being a recording of past or current financial performance, the budgeted income statement is more of a guide for a business’s future financial performance.

A budgeted income statement isn’t created on a whim though.

Rather, it is a compilation of several other budgets.

The accuracy of the budgeted income statement will greatly change depending on how on point and realistic these other budgets are.

Examples of these other budgets include the revenue budget, cost of sales budget, departmental expenses budget, etc.

Businesses use the budgeted income statement as a planning tool to steer their future financial performance for the upcoming period.

In some cases, a budgeted income statement can cover several periods.

If used properly, the budgeted income statement can help a business make better decisions such as allocating resources properly.

This is only possible if the budgeted income statement is prepared diligently with as much accuracy as possible.

Another use of the budgeted income statement is to test whether the prepared budget plans are feasible or not.

It also tests whether certain financial projections are reasonable and achievable.

If we use it in conjunction with the budgeted balance sheet, we can reveal certain scenarios that may not be financially supportable (e.g. accumulating a large amount of debt, shutting down a whole department).

This can give management a chance to remedy the situation by modifying certain budget assumptions.

How a Budgeted Income Statement Helps You and Your Business

We’ve already established that a budgeted income statement helps a business plan its future financial performance.

Aside from that, it also helps the business identify problems areas should it result in a negative net income.

A budgeted income statement can result in a positive or negative net income.

A positive net income may mean that the budget is acceptable and feasible.

However, the business still has to execute it in order to earn that projected income.

A negative net income (which is a loss) may mean that the business has to reconsider some if not all of its budget plans and assumptions.

Aside from that, it can provide the following benefits:

Assists with risk management

A budgeted income statement can determine whether or not a business has the resources to go through with a project or plan.

It also helps assess whether the project or plan is profitable.

This helps the business prevent making bad decisions such as approving unfeasible projects or needlessly overspending when it is avoidable.

A budgeted income statement can also shed light on potential additional expenses that the business might incur.

Helps with goal setting

Budgets help a business set its financial goals.

The budgeted income statement is no different.

It helps a business, as well as its employees, set and work toward common goals.

The estimates found on a budgeted income statement provide quantifiable goals for the various departments within a business.

Justifies the acquisition of assets and resources

Revenue and expenses go hand in hand. Operating a business comes with operating expenses.

It’s not like you can generate revenue out of thin air.

A budgeted income statement exposes the value of certain expenses (why they’re necessary) and what potential income they can bring into the business.

It can justify why certain assets must be purchased or why certain expenses must be incurred.

It makes it easier to approve budgets for projects that carry with them heavy expenses.

Coordinates efforts between different departments

A budgeted income statement can pave way for different departments to coordinate with each other.

For example, the purchasing department may need to hire an additional full-time employee.

The purchasing and HR department will then have to coordinate to justify the hiring of an additional employee.

Some projects may require the cooperation of several departments.

A budgeted income statement can identify which projects these are.

Helps with analyzing financial performance

A budgeted income statement is essentially a plan for financial performance for a certain period.

As such, it can be used to evaluate whether the actual financial performance for that period is as expected.

If the business performs better than what was budgeted (e.g. earning a higher revenue, spending less on expenses), then there is positive budget variance.

If it’s otherwise where the business performs worse, then there is negative budget variance.

While it may seem that a positive budget variance is ideal, having too much of it may indicate poor planning or budgeting.

The same goes for negative budget variance.

Having too much variance may also indicate budgetary slack.

Limitations of a Budgeted Income Statement

While the budgeted income statement can become a powerful tool, it still has its limitations.

First and foremost, a budgeted income statement is based on assumptions and estimates.

Setting a budgeted income statement based on relevant data can minimize the impact of this limitation.

However, there are just some factors that are virtually impossible to predict.

For example, nobody could predict the occurrence of the recent global pandemic. As such, it’s impossible to make a budget income statement that accounts for such.

The accuracy of a budgeted income statement greatly depends on its inputs.

If the people preparing the budgets are negligent in their preparation, the budgeted income statement will probably be faulty and irrelevant. It will not represent the future performance of the business.

As anyone involved in the budgeting process would know, creating a budget plan is time-consuming.

It isn’t something that you can do within a day. Rather, it’s a process that can last several days or even weeks. It also requires a certain amount of knowledge to make the budget effective and relevant.

Seeing that a budgeted income statement is a compilation of several other budgets, the effect of this limitation is amplified.

Lastly, the budgeted income statement is only a plan. Its execution is a different matter.

The different departments involved in its execution need to put in the work to achieve the set goals.

Actual performance will only equal budgeted performance if the business performs as expected.

Preparing a Budgeted Income Statement

Preparing a budgeted income is a very involved process.

First, we need to prepare the other budgets from which will be getting the data to construct the budgeted income statement.

We can prepare a quarterly or annual budgeted income statement, though preparing an annual budgeted income statement is preferable.

Once we secure the other budgets, we can construct our budgeted income statement.

We only need to prepare it just like a normal income statement.

First, we set the budget revenue according to the revenue or sales budget.

Next, we set the budget cost of sales (if there is any) according to the cost of sales budget.

The difference between the two figures will be our budget gross profit.

To illustrate, let’s have an example.

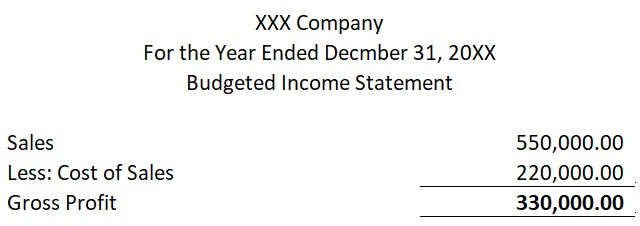

Let’s say we gather the following data from the sales department:

- Budgeted sales amount to $550,000

- Budgeted cost of sales amount to $220,000

As such, the revenue section of the budgeted income statement will look like this:

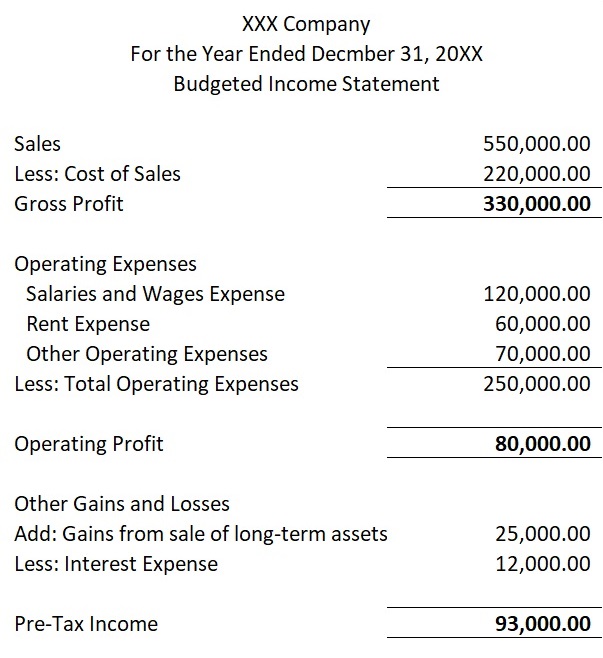

Next, we proceed with the operating expense section of the budgeted income statement.

We only need to input the budget operating expense items from the expense budgets prepared by the several departments.

Let’s assume that the budgeted operating expenses are the following:

- Salaries and Wages Expense – $120,000

- Rent Expense – $60,000

- Other Operating Expenses – $70,000

With this data, the budgeted income statement so far will look like this:

The next section of the budgeted income statement will include the estimate for other gains and losses.

This means income and expenses other than from operations such as gains from the translation of foreign currency, interest income or expense, or gain or loss from the sale of a long-term asset.

Let’s assume that the budget for other gains and losses are the following:

- Gain from sale of a long-term asset – $25,000

- Interest expenses -$12,000

The budgeted income statement so far should look like this:

The last section of the budgeted income statement contains the estimated tax that the business will pay.

Let’s assume that the tax rate for such a business is 21%. This means that the tax expenses will amount to $19,530.

We now have everything we need to complete the budgeted income statement. It should look like this: