Advance RefundingDefined with Examples & More

A bond is a type of debt instrument that businesses (usually banks) and the government issue.

It’s a fixed-income instrument, meaning that bondholders receive a certain amount of payment depending on what’s stated on the bond.

It could be in the form of monthly interest or a one-time payment at the end of the bond’s term.

Businesses issue bonds to fund their operations.

Meanwhile, government units such as state and local governments issue bonds to finance their projects as well as operations.

Bonds have an end date, which we refer to as their maturity date.

When a bond reaches maturity, the issuer pays the amount stated on the bond to the bondholder.

The bond then ceases to exist.

Government-issued bonds are particularly a popular choice among investors due to the relatively low risk.

They also carry some sort of tax exemption.

For example, treasury bonds are exempt from state and local taxes.

This makes them very attractive investments to risk-averse investors.

That said, government issued-bonds usually have a term of 20 to 30 years.

A lot can happen in that length of time.

The prevailing interest rate may become significantly lower than the interest rate stated on the bond (which is usually fixed).

This is favorable for the bondholder, but it’s heavily disadvantageous for the issuer.

In such a case, the issuer of the bond might want to avail of advance refunding.

I say issuer because the option to exercise advance refunding isn’t exclusive to the government.

Even private businesses can avail of advance refunding if they meet the conditions.

In this article, we will be learning what advance refunding is.

We will learn how and when it is applicable.

We will also learn why certain bond issuers avail of it.

What is Advance Refunding?

Before we talk about advance refunding, we need to learn first about refunding issues.

A refunding issue is when the proceeds of a bond issue are used to pay off an outstanding bond obligation.

For example, I have an outstanding bond obligation.

I issue another bond, then use the proceeds to pay off the existing bond obligation. This issue is a refunding issue.

When the proceeds of a refunding issue are withheld for more than 90 days before they are used to pay an outstanding bond issue’s obligations, that refunding issue is an advance refunding.

Bond issuers avail of advance refunding as it allows them to lock in lower interest rates.

It also gives them an out from burdensome covenants, all the while still honoring the call protection on the outstanding bonds.

Do note that advance refunding can only be availed of for callable bonds.

As a general rule, the present value savings from an advance refunding should be about 3% or more.

Anything less than that might mean that the advance refunding isn’t worth it.

The point here is that the new issue should result in better terms for the issuer.

It could be a lower interest rate. Or it could be fewer restrictions on the usage of the proceeds of the bond issue.

Whichever the case, it should end up with better conditions for the issuer.

Governments often avail of advance refunding to postpone their debt payments.

It is burdensome to pay off a large amount of debt outright after all.

Sometimes, a refunding issue (advance refunding included) may occur in conjunction with a new money issue.

Example of Advance Refunding

To better illustrate what advance refunding is, let’s have a simple example.

Let’s say that City X has an outstanding bond obligation.

The bond has a face value of $80 million and has a fixed interest rate of 12%.

Said bonds were issued in 1995 and they mature in 2015.

The bonds are callable, with the call option exercisable only in 2007.

In January 2001, the prevailing tax-exempt interest rates fall to 9%, which is 3% lower than the issued bond interest rate.

In January 2005, the prevailing tax-exempt interest rates further fall to 4%.

At this point, the difference between the bond interest rate and the prevailing rate is 8%.

City X decides to do something about it.

Paying interest of 12% when the prevailing rate is 4% is just too unfavorable.

That said, the bonds are only callable in 2007, which is still 2 years from 2005.

As per records, City X was able to pay $40 million of the $80 million principal.

That means that there is still an outstanding bond obligation of $40 million.

Thus, City X issues $52.5 million of new bonds, with 4% interest.

The new issue is set to mature in 2010.

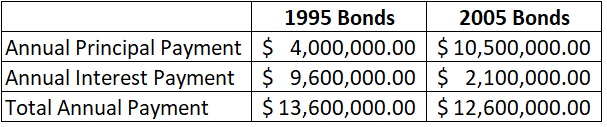

Here’s how the new issuance affects the payments of City X:

The table above shows that City X saves $1,000,000 ($13,600,000 – $12,600,000) in annual payment by issuing new bonds.

Do note that the original bond issue is only callable in 2007.

Until then, City X will have to pay on both bond obligations.

City X can create an escrow for the new bonds until such time that the original bonds become callable.

This is an example of advance refunding because the proceeds from the new bonds issued will be only used to pay the original bond issue after 2 years.

Regulation of Advance Refunding

Due to advance refunding potential for abuse, regulators have rightfully expressed concern over them.

Without regulations in place, issuers of bonds can use advance refunding to issue an indefinite amount of debt at a lower rate.

The bond issuer can then use the proceeds to invest in high-value investments.

To prevent such abuse from happening, regulators put in place rules that limit the tax-exempt status of refunding bonds.

Particularly on the interest that bondholders earn.

To bolster this, a provision in the Tax Cuts and Jobs Act of 2017 states that interest income is not tax-exempt for advance refunding bonds issued after Dec. 31, 2017.

Furthermore, IRS Section 149(d)(3)(A)(i) provides limitations on the number of times a bond can be advance refunded.

If the original bond was issued after 1985, one advance refunding is the limit.

This includes any bond that refunds the bond (the advance refunding in this case).

This means that the possibility of having infinite bond issuances is effectively culled.

Bonds originally issued before 1985 are allowed two instances of advance refunding, with some conditions (found here).

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

Internal Revenue Service "Advance Refunding Bond Limitations Under Internal Revenue Code Section 149(d)" Page 1 . April 8, 2022

Cornell Law School "26 CFR § 1.149(d)-1 - Limitations on advance refundings." Page 1 . April 8, 2022