Advance PaymentExplained with Journal Entry Examples

When ordering goods or services that are still deliverable at a future date, some businesses may require you to make an advance payment.

This is especially the case for high-valued or niche items.

For example, when pre-ordering a video game, the store may require you pay in advance.

It could be the full price of the game or it could be just a portion.

The point here is that the store requires you to pay even if you still have yet to receive the item that you’ll be paying for.

In some cases, businesses require advance payments from certain customers due to the latter’s negative credit history.

If the customer is regularly late on his/her payment, the business would want to protect itself from that.

And requiring an advance payment is one way to do it.

Allowing credit sales usually leads to an increase in revenue.

However, if it doesn’t lead to an increase in cash flow, it’s all just paper income.

Meaning that there’s only an increase in income in the books but in actuality, there’s no cash going to the business.

This happens when the business extends credit to all customers, no matter how bad their payment history is.

A proper credit policy can remedy this.

And of course, let’s not forget the topic of this article, advance payments.

Advance payments can also help in alleviating a business’s cash flow problems.

In this article, we will be learning about advance payments and what they are for the customer side as well as the business/supplier side.

We will also be learning how to account for them in your business’s books.

What is an Advance Payment?

An advance payment is a form of payment that some businesses require before the delivery or fulfillment of an order (goods or service).

It could be the full payment price of the order, or it could only be a portion.

Businesses require advance payments as a form of insurance.

They may not entirely eliminate the risk of non-payment, but they at least mitigate it.

That said, not all businesses require advance payments.

For example, a store that sells low-value goods won’t usually require advance payments.

Some businesses may require an advance payment for all of their goods and/or services.

Some may only require it under specific circumstances.

Here are some examples of such circumstances:

- A business may require advance payment from a customer who has a poor credit history. This means that the customer is habitually late on his/her payments, or in some cases, never pays at all. Extending credit to such a customer without insurance oftentimes leads to bad debts.

- A business may also require advance payments from its new customers. Since the business has no idea of the new customers’ credit history, it might want some form of insurance.

- Some products are so specialized to meet a customer’s specifications that they cannot be resold to another customer. As such, the business would require advance payment to protect itself in case the customer backs out of the order

- A business may already be operating at a limited or reserved capacity. For example, it may only be able to produce 100 units of a product. In such a case, the business may require advance payments to ensure that it can collect on all of its limited sales. Also, the advance payment may be a form of reservation on the part of the customer.

Accounting for Advance Payments

Accounting for advance payments as a customer is very different from doing it as a supplier.

Making advance payments creates an asset on a customer’s part.

On the other hand, receiving advance payments creates a liability on a supplier’s part.

As such, we will be discussing how to account for advance payments as a customer and as a supplier.

Accounting for Advance Payments as a Customer

First, let’s talk about how to account for advance payments as a customer.

This means that you’re the one making the advance payment.

As I’ve already said, making advance payments as a customer creates an asset.

Usually, it is some sort of prepaid account.

For example, you are a new tenant of an office building.

The owner required you to make an advance payment equivalent to three months of rent. Let’s say that a month’s rent costs $9,000.

The journal entry to record the advance payment should look like this:

Prepaid rent is an asset account that represents rent paid in advance.

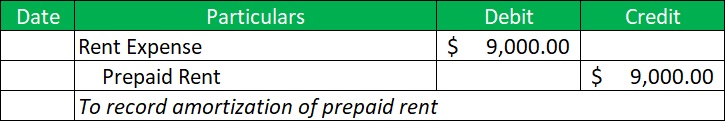

As you incur a month of rent, you amortize the prepaid rent account to record the corresponding rent expense:

Accounting for Advance Payments as a Supplier

Being a supplier means that you’re the one providing the service or goods.

In the case of advance payments, you’re the one receiving them.

Receiving advance payments creates a liability.

This is because you already receive payment for goods or services that are still to be delivered.

Meaning that you have the obligation to deliver such goods or services.

The corresponding liability account is usually a form of unearned revenue (or it could just be simply “unearned revenue”).

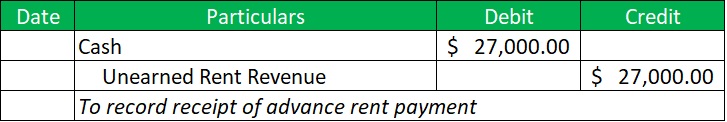

Let’s go back to the example above, but this time, let’s see it from the perspective of the landlord.

So to recap, you have a new tenant.

Your policy is that you require advance payments from new tenants, equivalent to three months of rent.

You charge this new tenant a monthly rent of $9,000.

The journal entry to record the receipt of advance payment should look like this:

Unearned Rent Revenue is a liability account that represents rent you’re yet to provide.

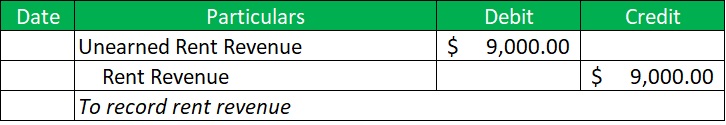

When a month passes, that means that the tenant has availed of a month’s rent.

That’s when you record rent revenue:

More Examples of Advance Payments

Here are some more examples of advance payments:

- When you pre-order a product that requires a certain amount of deposit. The deposit is an advance payment

- Gift cards can also be considered a form of advance payment. The business that provides them receives cash, but it still has to provide goods or services

- Some subscription services (e.g. magazines, journals, Netflix, etc.) offer you a significant discount when you pay for a whole year rather than paying month to month. This is usually a good deal for both the customer and supplier. The customer gets to pay a lower rate. The supplier gets an advance payment.

- Making monthly premiums to your insurance provider is a form of advance payment for services that they will provide at a later date

- Some contracted professionals require a downpayment for their services. This is usually the case for software-related jobs such as web development. The required downpayment can be considered an advance payment

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

Cornell Law School "48 CFR § 52.232-12 - Advance Payments." Page 1 . April 6, 2022