Advance/Decline RatioDefined along with Formula & How to Calculate

Investing in stocks can be intimidating for those who aren’t knowledgeable about how the stock market works.

You hear news of a certain stock suddenly soaring in value.

Then the next day, it plummets down to almost zero.

Sounds scary, don’t you think?

Just the thought of not knowing whether you win or lose with your investment is frightening.

No wonder why most new investors shy away from investing in stocks.

Some of these investors just let the experts do the investing for them.

Still, if you want to invest in stocks, accumulating knowledge about how to read the stock market is essential.

You’d want to know what your money is used for after all.

Relying on an expert doesn’t eliminate the risk of investing in stocks.

To not be blind about such risk, you’d want to know about it.

With how volatile and unpredictable the stock market can be, one can never have too many tools at his/her disposal.

Analysts use certain financial ratios to assess the strength of a stock.

The earnings per share (EPS) ratio is particularly useful in predicting the value of a stock.

There’s also the return on equity (ROE) ratio which is an indicator of how well a business is turning its shareholders’ money into profit.

And then there’s the Advance/Decline Ratio (ADR), which isn’t a financial ratio per se, but still helps in the analysis of the stock market.

In this article, we will be learning about the advance/decline ratio (ADR) and how analysts use it to determine market trends.

What is the Advance/Decline Ratio (ADR)?

The advance/decline ratio (ADR) is a technical indicator that analysts use to assess the current trend of the stock market.

This ratio compares the number of stocks that experienced a rise in value to the ones that experienced a decrease in value.

In short, it compares the advancing stocks/shares to the declining stocks/shares.

A stock/share is advancing when there is an increase in its value/price.

On the other hand, a stock/share is declining when there is a decrease in its value/price.

The calculation of the advance/decline ratio (ADR) is simple.

You only need to divide the number of advancing shares by the number of declining shares. Put into formula form, it should look like this:

ADR is calculated by dividing the number of advancing shares by the number of declining shares.

Where:

advancing shares – shares that increased in value

declining shares – shares that decreased in value

You can compute the advance/decline ratio (ADR) for different periods.

It could be a day, week, or month depending on the data that you need.

Additionally, the fact that its expressed in ratio form makes it easier to comprehend as opposed to using absolute values.

For example, instead of saying 20 stocks advanced while 16 declined for the day, you can say that the advance/decline ratio is 20:16 or 1.25.

What does the Advance/Decline Ratio (ADR) tell us?

On its own, the advance/decline ratio only tells us the level of advancing shares to declining shares for the specified period.

Not unlike other indicators, the advance/decline ratio unlocks its full potential when paired with other complementary metrics.

For example, analysts and investors can compare the moving average of the advance/decline ratio to the performance of certain market indices such as the NYSE and Nasdaq.

Through this comparison, they can assess whether only a minority of the company is driving the overall market performance.

Additionally, this comparison gives perspective as to the cause of a rally or sell-off.

A high advance/decline ratio may indicate an overbought market (when a stock or stocks sell for higher than intrinsic fair value).

On the other hand, a low advance/decline ratio may indicate an oversold market (when a stock or stocks sell for lower than intrinsic or fair value).

With this information, analysts can use the advance/decline ratio as a signal for whether or not the market is about to change directions.

We can also look at the advance/decline ratio on a trended basis.

Doing this gives us an idea of whether a market is about to enter a bullish or bearish trend.

If the ADR is increasing over time, it may indicate a bullish market trend.

In contrast, if the ADR is decreasing over time, it may indicate a bearish market trend.

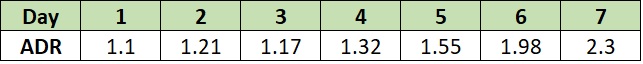

To illustrate, refer to the following table:

The table above is a series of daily ADRs computed over a period of 7 days.

As you can see, even with the drop on day 3, there is an overall increasing trend in the ADR.

This may indicate that the market is in a bullish trend (upward trend).

With this in mind, it’s always better to pair the advance/decline ratio with other complementary metrics.

The Advance/Decline Ratio (ADR): on a Trended Basis or By Itself

We can look at the advance/decline ratio on a trended basis or by itself.

Looking at the advance/decline ratio by itself can help us determine whether the market is oversold or overbought.

When the advance/decline ratio is relatively high, it may be an indication of an overbought market.

On the other hand, when the advance/decline ratio is relatively low, it may indicate an oversold market.

To put this into perspective, let’s use an example.

Let’s assume that the 15-day moving average advance/decline ratio was 1.33.

Then on the next day, the advance/decline ratio is 3.55. Since 3.55 is relatively higher than the moving average of 1.33, this may indicate an overbought market.

Looking at the advance/decline ratio on a trended basis can help us determine whether the market is on a bullish or bearish trend.

When the trend is overall increasing, it may indicate that the market is on a bullish trend.

On the other hand, when the trend is overall decreasing, it may indicate a bearish market trend.

Overall, the advance/decline ratio is another tool that investors and analysts use in reading the stock market.

It’s simple to calculate, but it provides a significant amount of information.

Recognizing the stock market direction changes is essential if you want to be successful in trading stocks.

And with the advance/decline ratio, you have a simple yet effective tool that can help you get a feel for such potential changes in trends.

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

University of Montant "Statistical significance in the New York Stock Exchange advancedecline line " White paper. April 8, 2022

NYU Stern "Technical Indicators and Charting Patterns" Page 1 . April 8, 2022