Activity-Based Costing (ABC)Defined with Steps and More

In product manufacturing, you’ll find that not all costs can be directly tied to a specific product or assembly line.

I mean you can if you take the time, but the cost of doing so often times outweigh the benefits.

Examples of these costs are the following:

- Cost of renting the space that houses the manufacturing process

- Cost of supplies used in the maintenance of machinery and equipment (e.g. oil, lubricants)

- Salaries and/or wages of supervisors or managers overseeing the manufacturing process

- Cost of utilities such as light, water, or gas for heating

While you cannot directly tie these costs to a certain product, they are still necessary for the operations of the business.

We refer to these indirect costs as the overhead costs.

Since you incur these costs during the manufacturing of a product, you still need to allocate them.

Only then can we determine the total cost of manufacturing a product.

Under the traditional costing method, you allocate the total overhead cost to each unit of product based on the volume of production resources consumed.

The rate of allocation will be based on the cost driver of your choosing.

For example, you may want to choose the number of direct labor hours consumed or machine-hours expended as your cost driver.

Once you determine the rate of allocation, you apply it evenly to all products.

The problem with this approach is that it doesn’t take into account the different activities involved in the manufacturing of different products.

Even if a business manufactures each product differently, the overhead cost is still applied evenly.

This can be detrimental if a business offers a diverse line-up of products.

But not to worry.

There is still another approach to costing.

We refer to it as Activity-Based Costing.

Activity-Based Costing: What is it?

Activity-based costing is a more complex and specific method of allocating overhead costs.

Under this method, you allocate overhead costs based on activities that drive the business’s overhead costs.

These are usually activities involved in the manufacturing of a product or the delivery of a service.

As a result, this costing method allocates overhead costs based on the relationship between the costs, overhead activities, and the end product.

It’s a less arbitrary method of allocating overhead costs to products compared to traditional costing methods.

Activity-based costing is usually used in the allocation of manufacturing overhead costs.

It specifically identifies activities that drive the cost of manufacturing.

This results in the allocation of costs that represents the relationship between costs and the activities involved in the manufacturing of a product.

In doing so, management can make a more informed decision when it comes to product pricing, product mix, and other manufacturing strategies.

Activity-based costing works best for businesses that have a complex manufacturing environment.

It could be that the business is offering products that are very different from each other.

As such, the activities involved in the manufacturing of each product are usually diverse.

For example, a business could be offering tech and industrial products.

Manufacturing a tech product is not the same as manufacturing an industrial product.

Conversely, activity-based costing may be overkill for businesses that have a streamlined manufacturing process where it is easier to allocate costs to products.

It could also be unnecessary for businesses that don’t have a significant amount of overhead costs when compared to total costs.

Spoiler alert: implementing activity-based costing is costly.

As such, implementing it when you don’t have to just unnecessarily adds more cost for your business.

Applying Activity-Based Costing

1) Identify the activities involved in the manufacturing of a product

The first step is to identify the activities involved in the manufacturing of a product.

Do this for every type of product that your business manufactures.

For example, let’s say your business manufactures two types of products: product A and product B.

Product A is your budget variant, whereas product B is your luxury variant.

Since product B is the luxury variant, it requires more attention to detail. Hence, more quality checks.

You identify the activities involved in the manufacturing of each product:

Product A

- Machine set-up

- Assembly of product A

- Quality testing of product A

- Packaging product A

Product B

- Machine set-up

- Assembly of product B

- Quality testing at 30%, 50%, and 100% of the manufacturing process for each unit of product B

- Packaging product B

2) Trace all costs associated with each activity, then assign them to different cost pools

The next step is to identify and trace costs to their respective activities.

For example, the cost of maintenance can be associated with any activity that involves the use of machinery or equipment.

Another example is the machine setup cost which can be traced to machine setup.

After you identify and trace the costs, you then assign them to different cost pools.

A cost pool is a pooling of individual costs related to an activity.

For example, manufacturing, or order processing.

In our example above, we identified four activities:

- Machine set-up

- Assembly of a product

- Quality testing; and

- Packaging

We will assign a cost pool for each activity, as well as an additional cost pool for machine maintenance.

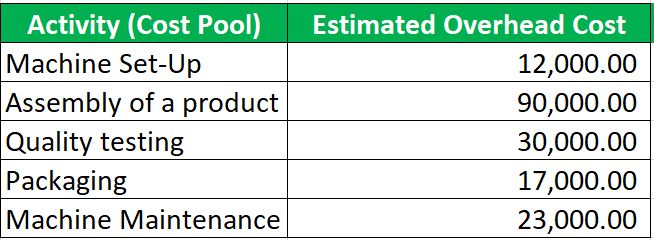

Let’s assume that these are the estimated overhead cost for each cost pool:

3) Assign an activity cost driver for each cost pool (e.g. units, hours)

After determining your cost pools, the next step is to assign an activity cost driver for each cost pool.

Activity cost drivers can be classified into two: transaction drivers, and duration drivers.

Transaction drivers are those involved with counting the number of instances an activity occurs.

For example, the number of machine set-up instances, how many times the business orders materials, etc.

Duration drives are those that measure how long it takes to complete an activity.

For example, the number of machine hours, direct labor hours, etc.

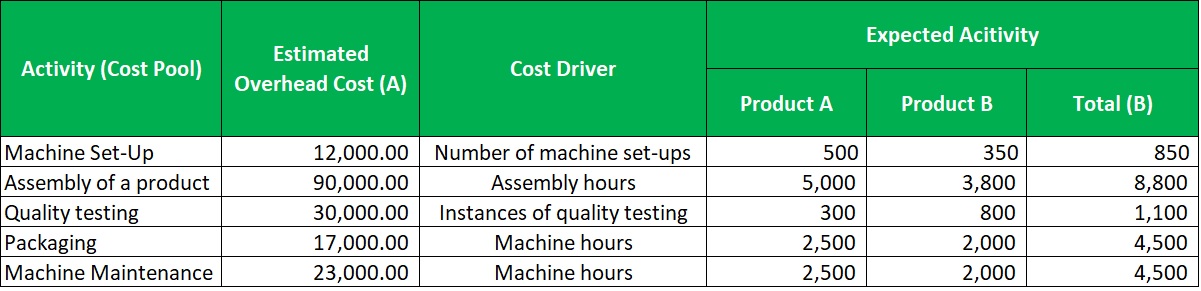

To continue with our above example, let’s assign a cost driver for each activity:

4) Determine the cost driver rate for each cost pool

The next step is to compute the cost driver rate for each cost pool.

You do this by dividing the total overhead cost for each cost play by the total cost driver.

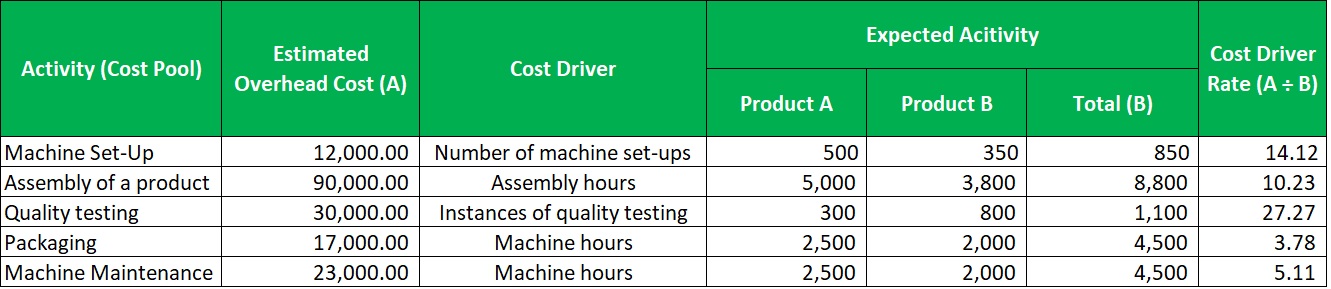

To illustrate, here’s the continuation of our example above:

As you can see, the overhead cost for each cost pool is divided by its respective total cost driver.

5) Multiply the cost drive rate by the number of cost drivers per product

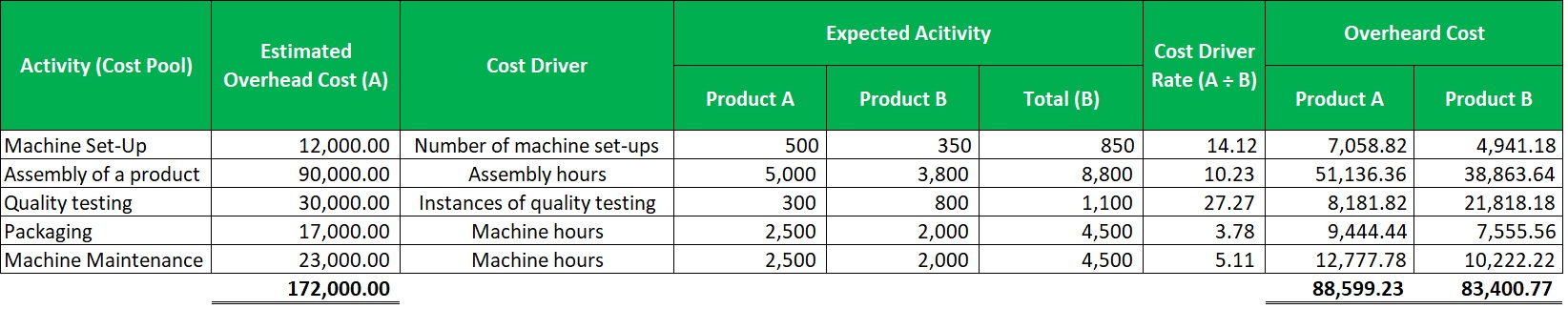

Now that we have our cost driver rate, we can finally compute the overhead cost of each product.

You can do this by multiplying the cost driver rate by the number of cost drivers per cost pool per product.

Then you add the total overhead for each cost pool to arrive at the total overhead cost of each product.

The Advantages of Activity-Based Costing

The most obvious advantage of activity-based costing is that it more precisely measures how overhead is used.

By allocating overhead costs vis-à-vis activities, you can have a clearer view of the relationship between the costs and activities.

Aside from that, here are the other benefits of using activity-based costing:

It provides you with a realistic and accurate costing of specific products

In traditional costing, you allocate overhead costs evenly regardless of the activities involved in the manufacturing of the product.

This can result in allocating more costs to products than the actual costs.

Activity-based costing does away with that.

By considering all the activities involved in manufacturing a product, you can have a more accurate measurement of the cost of the product.

You can assign specific overhead costs to certain products

Some products require more attention. Some products involve more activities in their manufacturing process.

And there are some products that are just costlier to produce.

Whatever the case, this is usually overlooked with traditional costing since overhead costs are evenly distributed according to the allocation rate.

By identifying the activities involved in the manufacturing process of a product, you’ll know the overhead costs that you’ll assign to it.

It allows you to assess the efficiency of production, as well as provide an opportunity to make improvements

By assigning value to indirect costs, they are given more attention and importance.

By identifying the activities involved in the manufacturing process, you can make improvements.

You may be even able to spot activities that are neither necessary nor value-adding.

You can reduce costs by removing these activities from the whole business operation.

This leaves you with only activities that are necessary and/or value-adding.

You can then be sure that every cost you incur has value.

You’ll have more precise data for profit margins

Since indirect costs can be more precisely allocated to different products with activity-based costing, you’ll have a more accurate representation of your profit margins.

By knowing the cost involved in the manufacturing of a product, management will be able to make better pricing decisions.

With activity-based costing, it’s easier to identify products that have little to no value.

These are products that have a high cost of production but have a low rate of return. You can then choose to discontinue such products and instead allocate your resources to more cost-effective ones.

The Disadvantages of Activity-Based Costing

But of course, the benefits that activity-based costing provides come with a cost.

It is time-consuming and costly

Activity-based costing is a time-consuming process.

You’ll have to identify the different activities as well as their associated costs.

And then you have to assign cost pools and cost drivers.

It is much more time-consuming than the simplistic approach of traditional costing.

It’s also costly too.

You either have to assign a team to gather the data required for activity-based costing.

Or you can outsource the process.

Either way, you’ll be shelling out resources just to start an activity-based costing system.

The data needed for activity-based costing may not be readily available

This can be the case when first starting with activity-based costing.

The data you need may not be readily available. And to collect the data you need, you may require the use of specific software.

Which means an additional cost. Also, since activity-based costing is different from traditional costing, it will take time to understand it.

So even with the software available, you’ll need time to understand which data you need to gather.

Reports made with activity-based costing don’t always conform to GAAP, thus, cannot be used for external reporting

If the cost of starting and maintaining an activity-based costing system doesn’t turn you off, this might.

Reports made with an activity-based costing system don’t always conform to GAAP.

This means that you cannot use them for external reporting.

You’ll have to prepare a separate report that conforms to GAAP or IFRS.

And that means consuming additional resources.

It’s not worth it if the total overhead cost is only a small portion of total costs

Using activity-based costing when your overhead cost is only a small portion of total costs is overkill.

It isn’t efficient and isn’t worth the cost.

You’re better off going with traditional costing instead.

Conclusion

Activity-based costing is another approach to the allocation of overhead costs.

It is a more complex and precise process of associating costs with the activities of the business.

While it is usually used by businesses within the manufacturing industry, it has found success in other industries too.

It is the recommended method of costing if your business’s total overhead cost is significant portion of your total costs.

However, it requires understanding and as such, may not always be the best choice for a business.

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

Sacramento State University "Activity-Based Costing (ABC) & Activity-Based Management (ABM)" Chapter 5. February 2, 2022

Ohio University "Using Activity-Based Costing (ABC) to Increase Profitability" Page 1 . February 2, 2022

Alamo Colleges District "Activity Based Costing" Page 1 - 3. February 2, 2022