1040 vs 1099What are the Form Differences

It’s almost the end of the first month of the new year.

Do you know what means for us, income-earning individuals?

It means the deadline for the submission of tax forms draws nearer and nearer!

In fact, the Internal Revenue Services (IRS) has just announced that it’ll start accepting and processing 2021 tax returns on January 24, 2022.

The tax season has officially begun in the US.

Don’t forget to file your income taxes on time to avoid penalties.

The tax season can be very daunting for a newcomer.

This is more pronounced if you are dealing with it on your own.

Thankfully, the IRS has been working on simplifying forms to make the whole process of filing taxes much easier.

Still, if it’s your first time filing taxes, filing tax returns can be quite challenging.

And there being many IRS forms doesn’t help with things either.

For example, there’s Form 1040.

And then there’s Form 1099… actually, there are many variations of form 1099 such as the form 1099-NEC, 1099-INT, etc.

Makes you think if there are other IRS forms in between the two huh?

But let’s not talk about that for now. Let’s focus more on forms 1040 and 1099 as you’re more likely to come across these than the others.

Good news! Comparing forms 1040 and 1099 isn’t as complicated as you think it is.

It’s actually pretty straightforward.

The very first thing that you must keep in mind is that IRS form 1040 is more of a master sheet.

It includes the details of your income that can be found in other tax forms.

That includes income stated in your 1099 forms (if you have any).

Read on so that you can further understand the difference between these two forms.

Form 1040 – what is it?

As I’ve already mentioned, IRS form 1040 is more of a master sheet.

It includes data about all of an individual’s income and deductions.

It also shows an individual’s taxable income, as well as the taxes they still owe.

In cases where the individual paid more than what they owe, form 1040 will show how much tax refund they can claim.

And depending on the type of income that the individual has to report, they may need to attach additional forms (which we refer to as Schedules).

IRS form 1040 is how income-earning individuals in the US file their taxes.

Before, individual taxpayers have of choice of filing Form 1040A or Form 1040EZ.

However, since the 2018 tax year, the newer and shorter Form 1040 replaced the two forms.

In its current iteration, Form 1040 is only two pages long.

You can basically divide it into these parts:

- Information about the individual taxpayer

- All of the individual taxpayer’s income

- All the deductions that the individual taxpayer can claim

- Information about the individual taxpayer’s total tax

- Information about all the tax withheld from the individual taxpayer (such as tax withheld from 1099 and W-2 forms)

- The tax that the individual taxpayer still owes or the tax refund that s/he can claim

Information about the individual taxpayer

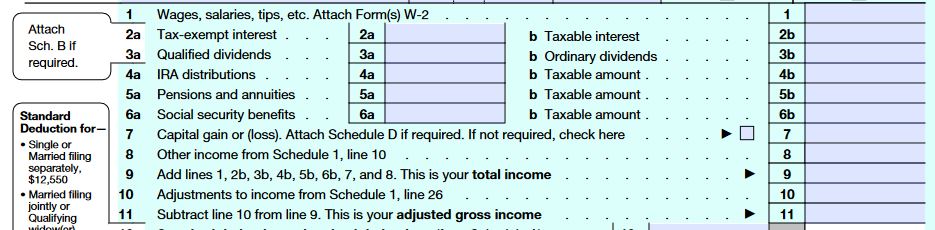

Lines 1 – 11: Information about all of the individual taxpayer’s income (from all sources)

Lines 12 to 14: Information about all deductions that the individual taxpayer can claim; Line 15 shows the individual taxpayer’s taxable income

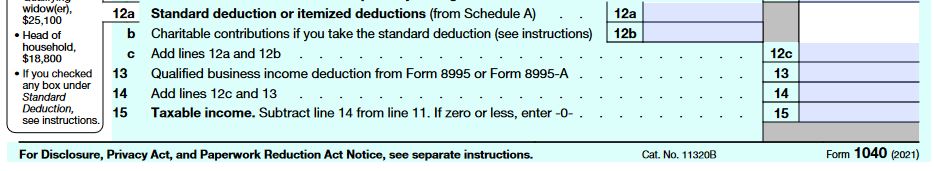

Lines 16 to 24: Information about the individual taxpayer’s total tax

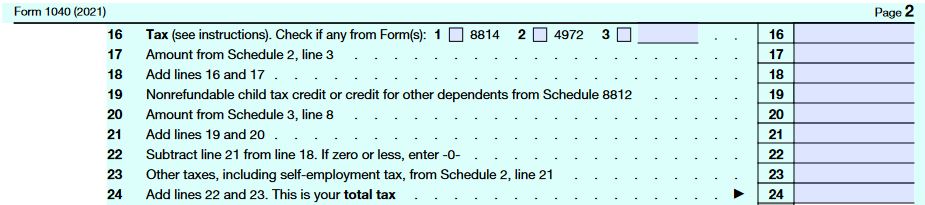

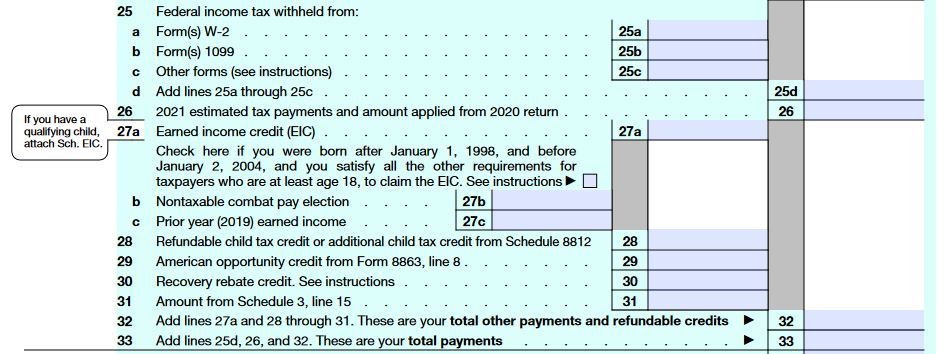

Lines 25 to 33: Information regarding the individual taxpayer’s tax credits and payments (e.g. tax withheld from 1099 and/or W-2 forms, refundable child tax credit, etc.)

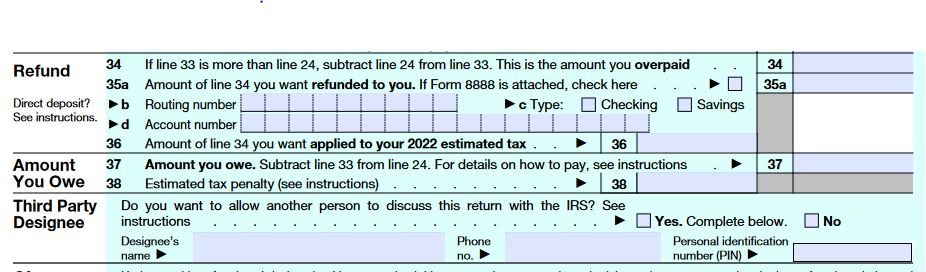

Lines 34 to 38: Information about the tax refund that the individual taxpayer can claim or the tax that s/he still owes.

The “Refund” section will only contain data if line 33 is more than line 24.

It includes information about the tax refund that the individual taxpayer can claim.

On the other hand, the “Amount You Owe” section will only include data if line 33 is less than line 24.

It includes information about the tax that the individual taxpayer still owes.

It also includes the penalties, if there are any.

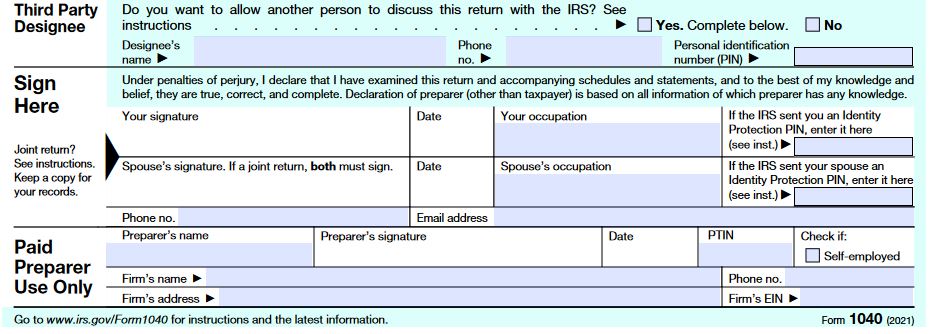

Section where the individual taxpayer signs his/her signature. The “Third Party Designee” section is for when the individual taxpayer allows a third party to deal with the IRS. The “Paid Preparer Use Only” is only used if a paid preparer prepared the form.

Schedules (to be attached to Form 1040)

Aside from Form 1040 itself, the individual taxpayer will have to attach additional forms (which we refer to as schedules).

The following are some of the Schedules that you may have to fill out and attach:

- Schedule 1: Additional Income and Adjustments to Income

- Schedule 2: Additional Taxes

- Schedule 3: Additional Credits and Payments

These three numbered schedules will include information about an individual taxpayer’s additional income, taxes, credits, and payments that are not directly reported on Form 1040.

If there are adjustments to income, they can be found on schedule 1.

- Schedule A: Itemized Deductions

You use this form if you want to claim itemized deductions instead of the standard deduction.

- Schedule C: Profit or Loss from Business

If you’re a sole proprietor, you’ll have to attach this schedule to your Form 1040.

Form 1099 – what is it?

1099 forms, also known as information returns, are IRS forms that include information about an individual’s income that is other than salary or wages.

Basically, 1099 forms report an individual’s income information that isn’t found on his/her Form W-2.

There are many different types of Form 1099, each reporting a certain type of income.

That said, it’s unlikely that you’ll be encountering them all.

So let’s discuss instead the 1099 forms that you’re most likely to encounter:

Form 1099-NEC – Nonemployee Compensation

Source: Form 1099-NEC

If you are a freelancer, independent contractor, or self-employed individual, you’re probably already familiar with Form 1099-NEC.

It reports the income you received from each client.

Meaning that if you have multiple clients, expect that you’ll receive at least one Form 1099-NEC from each client.

But just because you provided goods or services to a client doesn’t automatically mean that you’ll receive a Form 1099-NEC from said client.

Your cumulative earning within the year from the same client must at least be $600 for you to expect a Form 1099-NEC from him or her.

That said, you still have to report your earnings from all clients even if they didn’t individually reach the $600 threshold.

For example, let’s say that you’re a freelance virtual assistant.

A company contracted your services for the year.

If the income payments you received from the company reached a total of at least $600 for the year, then expect to receive a 1099-NEC from said company.

Aside from that, here are the other income items that can be found on a 1099-NEC form:

- cash payments made for fish (or other aquatic life) purchased from anyone engaged in the trade or business of catching fish; and

- payments made to an attorney for his/her services.

1099-MISC – Miscellaneous Information

Source: Form 1099-MISC

Form 1099-MISC covers a wide range of income payments.

But, did you know that before the reintroduction of Form 1099-NEC, the Form 1099-MISC is where you’d find information regarding income payments made to independent contractors?

Here are the income payments that a Form 1099-MISC captures:

- At least $10 in royalties or broker payments in lieu of dividends or tax-exempt interest.

- A cumulative total of at least $600 during the year (for each payee):

- Rents

- Prizes and awards that are not for services performed (except those given/awarded to your employees)

- Other income payments

- Medical and health care payments

- Crop insurance proceeds

- Generally, the cash paid from a notional principal contract to an individual, partnership, or estate

- Payments to an attorney in connection with legal services (e.g. payments made to an attorney in a settlement agreement)

- Any fishing boat proceeds; In addition, report cash payments of up to $100 per trip that are contingent on a minimum catch and are paid solely for additional duties (such as mate, engineer, or cook) for which additional cash payments are traditional in the industry

- Any excess golden parachute payments

- Section 409A deferrals

- Nonqualified deferred compensation

- For Box 7, enter an “X” if you made direct sales totaling $5,000 or more consumer products to the recipient for resale (sales made to a permanent retail establishment are not included). Do not enter a dollar amount on it

You must note the income payments made to an attorney you report on a 1099-MISC form aren’t the same as those to you report on a 1099-NEC form.

Form 1099-NEC reports payments made to an attorney for his/her services.

On the other hand, Form 1099-MISC reports payments made to an attorney in connection to legal services (e.g. those made in a settlement agreement).

Other 1099 forms available on the IRS website (along with their links)

- 1099-A, Acquisition or Abandonment of Secured Property

- 1099-B, Proceeds From Broker and Barter Exchange Transactions

- 1099-C, Cancellation of Debt

- 1099-CAP, Changes in Corporate Control and Capital Structure

- 1099-DIV, Dividends and Distributions

- 1099-G, Certain Government Payments

- 1099-H, Health Coverage Tax Credit (HCTC) Advance Payments

- 1099-INT, Interest Income

- 1099-K, Payment Card and Third Party Network Transactions

- 1099-LTC, Long-Term Care and Accelerated Death Benefits

- 1099-PATR, Taxable Distributions Received From Cooperatives

- 1099-OID, Original Issue Discount

- 1099-Q, Payments from Qualified Education Programs (Under Sections 529 and 530)

- 1099-R, Distributions from Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.

- 1099-S, Proceeds from Real Estate Transactions

- 1099-SA, Distributions from an HSA, Archer MSA, or Medicare Advantage MSA

Form 1040 vs Form 1099: what’s the difference?

The biggest difference between Form 1040 and Form 1099 is that Form 1040 is a tax return that all individual taxpayers file (though some senior citizens may file a variation which is the Form 1040-SR).

Meaning that Form 1040 is an essential tax return for individual taxpayers.

On the other hand, not all individual taxpayers file or receive a Form 1099.

Only those who have earned income that is neither salary nor wage will encounter a Form 1099.

If you’re an individual whose only source of income is from salaries or wages, then you probably don’t have a Form 1099.

With that said, 1099 forms are more supplementary documents to support an individual taxpayer’s Form 1040.

If you did receive 1099 forms, you’ll have to aggregate all of them and report them on your Form 1040.

For example, on top of being employed, you also do freelance writing services.

If you received income payments from various clients, all reported via 1099-NEC forms, then you’ll have to report all of those income payments on your Form 1040.

Another difference is that a Form 1099 isn’t filled up by the individual taxpayer (who received income payments).

Instead, it’s filled up and reported by the party who made the income payments. In a way, a Form 1099 is similar to a Form W-2.

On the other hand, a Form 1040 is generally filled in and reported by the individual taxpayer who received or made income within the tax year.

To summarize, Form 1040 is an essential tax return that summarizes all of an individual taxpayer’s income, deductions, tax credits, tax payments, and tax due (and still due).

Meanwhile, Form 1099 is more of a supplemental document used to support an individual taxpayer’s Form 1040.

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

IRS.gov "About Form 1040, U.S. Individual Income Tax Return" Page 1 . January 24, 2022

IRS.gov "About Form 1099-MISC, Miscellaneous Income" Page 1 . January 24, 2022