Variable Expense

When accounting for your business’s expenses, you’d notice that some expenses remain the same no matter what the level of production or sales is.

Then there are expenses that go up or down along with the increases or decreases in production or sales.

And then there are those that change every month but don’t necessarily relate to changes in production or sales and are instead affected by other factors.

For example, your cost of goods sold changes depending on your business’s level of sales.

If sales increases, the cost of goods sold increases too.

If sales decreases, the cost of goods sold decreases.

Another example would be the payments you make for wages.

It varies depending on how many hours your employees (who are paid an hourly rate) rendered.

One example of an expense that changes but is not due to changes in production or sales is the office supplies expense.

It varies depending on the consumption of your staff instead.

There may be months where consumption is low, and consumption is high.

These expenses that change every now and then are what we call variable expenses.

Having an understanding of your business’s variable expenses will help you in determining how much you should be pricing your products.

It could also help you in determining how much you’ll be spending and earning at different levels of sales or production.

What is an expense?

As defined by the International Accounting Standards Board (IASB) expenses are “decreases in economic benefits during the accounting period in the form of outflows or depletions of assets or incurrences of liabilities that result in decreases in equity, other than those relating to distributions to equity participants. ”

This means that anything that decreases your net worth, with or without cash outflow, is an expense.

What is a variable expense?

A variable expense, as its namesake suggests, is an expense that varies in amount depending on certain levels of activity.

It could increase or decrease depending on the changes in production, sales, or other activities.

Budgeting an exact amount for variable expenses can be tricky because of their varying nature.

Variable expenses can be broken down into two categories – those that go directly towards the cost of sales (which is also referred to as variable cost), and those that do not (variable operating and non-operating expenses).

Variable costs are influenced by a business’s level of production or sales.

For example, if production is up, then the cost of direct materials goes up too.

Or when sales are down, then the cost of sales will also go down.

Variable costs will likely influence a business’s pricing more than its fixed costs.

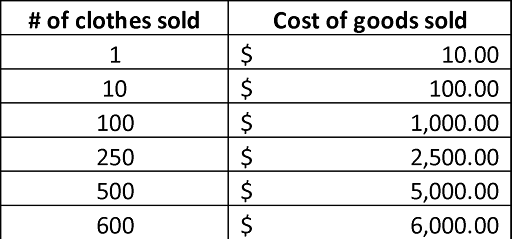

To illustrate, imagine a clothing store.

Let’s assume that the clothes it offers are all of the same value and that they cost $10 each.

Let’s further assume that there are no other variable costs.

The table below shows the amount of variable cost at different levels of sales.

As can be seen from the table above, the total cost of goods sold increases as more clothes are sold.

The other variable expenses (operating and non-operating expenses) also change depending on the level of certain activities.

For example, if a business offers sales commissions to its employees, then the related expense will depend on the business’s level of sales.

If a company offers production bonuses, then it will depend on the company’s level of production.

Office supplies expense will depend on the consumption level of a business’s office staff.

Aside from the variable expenses varying depending on certain levels of activity, they can also go up or down depending on outside factors.

For example, if one of your suppliers increases their price, then your variable cost per unit will increase too.

Or if another of your suppliers offers a discount when you purchase a certain number of goods from them, then your variable cost per unit will decrease.

Common Examples of Variable Expenses

The following are common examples of variable expenses:

Cost of goods sold

Cost of Goods Sold refers to the cost of goods that were sold in a given period.

For businesses that do retail or wholesale, the cost of goods sold will include all of the cost directly attributable to the products that were sold (e.g. purchase price, shipping cost, etc.).

A business’s cost of goods sold increases or decreases in accordance with its sales.

If sales go up, the cost of goods sold goes up.

If sales go down, the cost of goods sold goes down.

For example, let’s assume that a certain store that retails a certain brand of soda has a cost of goods sold of $2 per can of soda.

If the store sells 100 cans of soda, its total cost of goods sold would be $200.

If it sells 1,000 cans of soda, the total cost of goods sold would be $2,000.

If it sells 3,000 cans of soda, the total cost of goods sold would be $6,000.

For businesses that are in the manufacturing industry, the cost of goods includes more items: the cost of direct labor, direct materials, and manufacturing overhead attributable to products sold.

The cost of direct labor and direct materials are typically variable while manufacturing overheard can either be variable or fixed.

Utilities expense directly attributable to the production of goods

One of the aforementioned manufacturing overhead, the cost of utilities can become a variable expense if it can be reliably attributed to the production of goods.

Pieces of machinery and equipment used in the production of goods will consume water and electricity.

For example, let’s say that a piece of machinery consumes $4 of water and energy for every 1 unit of goods it produces.

If it produces 100 units of goods, then you’ll incur $400 of utilities expense, and it only goes up as it produces more units.

Wages

Wages refers to the payments you make to your employees who are paid on an hourly basis.

It is different from salaries which are fixed payments.

Wages depend on the number of billable hours your employees rendered.

Wages of employees who are directly involved in the production of goods form part of a business’s cost of goods sold.

They are referred to as direct labor.

Direct labor can also increase or decrease depending on a business’s level of production.

This is because if a business increases its production, it would usually need to pay more for increased labor.

If production slows, employees’ hours are usually reduced which will result in lower direct labor.

Wages of employees who are not directly involved in the production of goods can either form part of a business’s cost of goods sold (as manufacturing overhead – indirect labor) or its operating expense.

These wages usually don’t change along with increases or decreases in production but are rather dependent on the billable hours rendered by such employees.

If employees regularly render paid overtime, then wages will be higher than usual.

Sales Commission

Sales commissions are variable expenses in the sense that they vary based on a business’s sales or any other indicators that directly relate to the number of products sold.

They are unlike salaries which are paid in fixed amounts.

The amount of sales commission typically changes along with changes in sales.

For example, a car salesperson gets paid a 15% commission for every unit s/he sells.

Depending on how many units the salesperson sells, the sales commission will vary.

If s/he wasn’t able to sell anything for a month, then there would be no sales commission to be paid.

If s/he sold 10 units at $40,000 each, then s/he will be paid $60,000 sales commission.

Office Supplies

This expense refers to the supplies (e.g. paper, pen, pencil, paper clips, printer ink) that are used/consumed by a business’s office staff.

Unlike the previous expenses that vary depending on production or sales levels, the office supplies expenses vary depending on the office staff’s level of consumption.

Fuel expense for company vehicles

Cars need fuel to run.

That’s why if a business has company vehicles, then the fuel these vehicles consume will form part of its variable expenses.

The amount will vary depending on fuel consumption and gas prices (which are known for frequently changing).

The Contribution Margin (a.k.a. variable contribution margin)

The contribution margin is a metric the measures the difference between revenue and variable expenses (sometimes only variable costs).

The contribution margin is used in computing a business’s break-even point.

The formula for computing contribution margin is as follows:

Contribution Margin is calculated by subtracting Variable Expenses from Revenue, then dividing that result by Revenue.

-or-

Contribution Margin = (Revenue – Variable Cost) ÷ Revenue

The first formula is used if a business has variable expenses other than variable costs.

If there are none, then the second formula is used.

This is important to note because if we fail to account for any variable expense, then we will arrive at the wrong figure for the contribution margin and the break-even point.

To illustrate, let’s say that you own a pastry shop.

Let’s assume that your revenue is for the year is $200,000 and that your variable expenses total $120,000.

We want to what your contribution margin for the year is.

Contribution Margin = (Revenue – Variable Expenses) ÷ Revenue

Contribution Margin = ($200,000 – $120,000) ÷ $200,000

Contribution Margin = $80,000 ÷ $200,000

Contribution Margin = 0.4 or 40%

As per computation, your contribution margin is 0.4 or 40%.

Let’s say you have fixed expenses of $60,000.

Let’s determine your break-even point.

Break-even point = Fixed expenses ÷ contribution margin

Break-even point = $60,000 ÷ 40%

Break-even point = $150,000

Your break-even point is $150,000.

This means that if costs remain at the same level, you’d need to generate at least $150,000 to not incur losses.

Conclusion

Variable expenses are any expenses that vary in amount depending on a certain level of activity.

It could vary depending on the level of sales, production, or even consumption.

Not all variable expenses form part of a business’s cost of sales, as some of them form part of operating or non-operating expenses.

Examples of such expenses are office supplies expense, sales commission, wages for admin staff, etc.

Variable expenses that form part of your business’s costs of goods sold can also be referred to as variable costs.

Examples of variable costs are the cost of direct material used in production, the cost of direct labor, the cost of goods sold (for retail and wholesale), variable manufacturing overhead, etc.

Having an understanding of your variable expenses will help in determining your contribution margin and also, your break-even point.

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

International Accounting Standards Board "Extract from The IASC’s Framework for the Preparation and Presentation of Financial Statements" Page 1. October 25, 2021

Harvard Manage Mentor "Print this page Fixed and variable costs" Page 1. October 25, 2021

Texas Southern University " Comparison of the Contribution Income Statement with the Traditional Income Statement" Page 1. October 25, 2021