Suspense AccountDefined & Explained along with Examples

What is a Suspense Account?

Suspense Accounts are used both in accounting and investing.

In accounting, a suspense account is a temporary account where entries that do not have a clear classification as to how they are to be recorded are parked until such time that accountants will be able to correctly determine where they should record the transaction.

Most of the time, the transactions under suspense accounts are investigated and its source documents reviewed before they can be properly classified.

In investing, a suspense account is a type of brokerage account where investors temporarily park their cash until they are certain which investments they want to purchase, and will use the cash stored in their suspense account to pay for those investments.

Understanding Suspense Accounts

A suspense account is an example of a temporary account – an account to temporarily hold journal entries that are ambiguous or bookkeepers are unsure of as to where to record them.

When it comes to bookkeeping, accuracy plays an important role to provide relevant, reliable and timely financial reports.

This is why transactions must be correctly posted to their proper accounts.

A common practice of recording in suspense accounts is when a company receives a payment from a particular client but the invoice number is not specified.

For future reconciliation purposes, a company cannot simply record a payment towards any invoice – they must be specific and accurate.

Another example would be if a company makes a payment towards their vendors but the vendor has provided the wrong bank details.

Until corrected and the payment has already been cleared from the bank of the company, the transaction stays in the suspense account.

Companies decide how often they want to review the entries recorded under suspense accounts.

For smaller companies, they will be able to conduct a review once a month or once in every quarter since transactions are few.

For bigger companies that record cash outflows and inflows on a daily basis, it makes sense to do a more frequent review of their suspense accounts.

Once accountants have determined the proper classification of the journal entries, it will be recorded to their correct accounts and removed from suspense accounts.

When accounts are closed, so should suspense accounts and the suspense balance must be brought down to a zero.

Account Type of a Suspense Account

Suspense accounts are considered as general ledger accounts and can either be an asset or a liability depending on the transaction.

When the uncategorized transaction is under Accounts Receivable, it is considered a current asset.

When the transaction in question has something to do with the Accounts Payable, the suspense account is considered to be under current liabilities.

Examples of Suspense Accounts

There are many reasons why companies use suspense accounts.

It can be from receipt of payments from customers but the invoice number is not referenced in the payment, a payment to vendors but the asset has not been received yet, bookkeepers are unsure how to classify transactions, or they have received a payment but do not know where the payment came from.

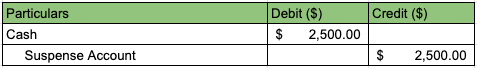

For example, a company received $2,500 of payment but there is no other information included in the receipt of funds in the company’s bank account.

To record this transaction, the bookkeeper will post this journal entry:

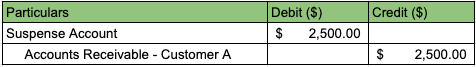

A few weeks later, Customer A has sent the payment details for the above receipt with a reference to Invoice # 61109xyz.

To correctly record the transaction under the suspense account, the bookkeeper will make another journal entry:

Suspense accounts serve as an important tool so that companies are able to properly classify accounts.

This will in turn help companies prepare relevant reports based on accurate data.

Mortgage Suspense Accounts

Typically used by mortgage lenders, suspense accounts in mortgages prove to be an excellent tool for mortgage lenders to temporarily hold the funds of borrowers if they fail to pay in full or only make partial payments on their mortgage.

It serves as a vessel that secures mortgage payments and mortgage vendors will have the discretion whether to apply the funds to the principal amount of the mortgage, interest, payment on property tax or towards homeowners’ insurance programs.

In the case of borrowers, some practice dividing monthly payments into two so as not to pay all at once.

Mortgage vendors then keep the first payment in the suspense account until the second payment is received for the month and the payment is complete and recorded to its correct account.

Brokerage Suspense Accounts

Brokerage suspense accounts act as funds for investors who are planning to reinvest their money and are yet to decide which investments they wish to go ahead with.

Just like the mortgage suspense account, investors keep their money in this account until such time that they are ready to purchase new investments.

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

UC Davis "Best Practices for Clearing, Default and Suspense Accounts" Page 1 . November 29, 2021

West Virginia University " An Introduction to Payroll Suspense Accounts" Page 1 . November 29, 2021