Profit and Loss Statement

When your business is earning, you’ll know it.

You’ll have enough (or more) to pay your employees, your suppliers, your creditors.

You’ll have enough to purchase more products to sell or invest in the growth of your business.

You’ll have enough to pay all of your business’s costs and expenses without having to dip into your savings.

When your business is losing, you’ll know it too.

You’ll start struggling with making ends meet.

Your payments to your employees, supplier, and creditors might be delayed.

You might even think of halting that business expansion that you were planning.

You’ll probably have to shell out cash from your savings.

It isn’t a good feeling overall.

However, it isn’t always immediately obvious whenever your business is earning or losing.

Sometimes, you may receive a huge injection of money and it may feel like your business is earning, but then you’d later find out that you’re actually losing money.

If a large amount of capital is constantly going and out of your business, it can be hard to determine whether you’re making a profit or not.

It can get a little frustrating huh?

Won’t it be wonderful if you have a document that can record the exploits of your business, whether it be earning or losing?

Something that you can present to yourself, your employees, co-owners, investors, and outside parties such as creditors and government agencies?

A document that can put numbers on what’s actually going in and out of your business?

Well, you’re in luck!

Such a document exists and it’s called the Profit and Loss Statement.

Profit and Loss Statement: What is it?

Also referred to as the P&L Statement, Income Statement, Net Income Statement, Statement of Earning, or Statement of Operations, the Profit and Loss Statement is a document that presents you information about a business’s revenue and expenses for a given period.

It can show you how much a business has earned (or lost).

It is one of the three main financial statements that a business regularly prepares, the other being the Balance Sheet and the Cash Flow Statement.

A Profit and Loss Statement can provide you an overview of your business’s financial performance and health.

It can show you how much revenue your business generated, how much cost was incurred in order to generate such revenue, the other expenses necessary for the operations of the business, and even non-operating income and expenses.

And at the very end, it shows you how much net income was generated by your business after all revenues and expenses are considered.

It’s a very useful and important document that offers you the means to monitor the performance and growth of your business.

By comparing profit and loss statements from several periods (usually consecutive periods), you can see if there is growth in your sales, or if there is a trend of increasing costs and expenses.

Knowing these can help you and your business in setting your targets, budgets, and forecasts.

What is Profit? What is Loss?

So we’ve been talking about the Profit and Loss Statement, but we haven’t talked about what a profit or a loss is yet.

Either one of the two is what you get after you’ve deducted all of your business’s costs and expenses from all revenues.

A profit occurs when the revenues exceed expenses.

On the other hand, a loss occurs when expenses exceed revenues.

A profit is favorable for a business, while a loss isn’t.

In most profit and loss statements, there are three levels of profit (or loss) that are presented which are the Gross Profit, the Operating Income, and the Net Income.

Gross profit is the result when deducting the cost of sales from revenue.

Operating income is a step further as it also considers operating expenses in the equation.

Net income is usually the last figure you’d see in a profit and loss statement.

It is the result of adding income from all sources (revenue and non-operating income) and deducting expenses from all sources (cost of sales, operating expenses, non-operating expenses, and income tax expense).

Some profit and loss statements have additional profit (or loss) items such as EBITDA (earnings before interest, taxes, depreciation and amortization), EBIT (earnings before interest taxes), and EBT (earnings before taxes).

Do note though that these are not official GAAP measures.

What Information Are Needed to Prepare a Profit and Loss Statement?

The minimum information you need to prepare a profit and loss statement includes the business income from all sources (revenue and non-operating income), and expenses from all sources (cost of sales, operating expenses, non-operating expenses, income tax).

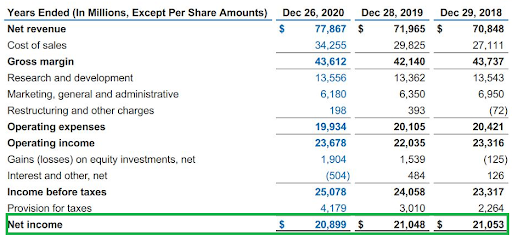

Here’s an example of a profit and loss statement as a reference to how information is presented:

The usual order in which information is presented in a profit and loss statement is as follows:

- Revenue/Gross Sales/Gross Revenues – this line item refers to the total of your business sales. You can sub-categorize it according to the type of revenues your business is earning. For example, if your business is offering both goods and services, you can sub-categorize revenue into “sales from goods” and “sales from services”. Or if your business is earning multiple products/brands, you can sub-categorize revenue according to the products/brands offered.

- Sales Discounts, Returns, and Allowances – refers to the total of returned sales, discounts, and sales allowances. This is applicable for businesses that offer goods and accepts returns, offer sales discounts, or provides allowances for returns. Not all businesses have this line item.

- Net Sales/Net Revenue – when Sales Discounts, Returns, and Allowances are deducted from your Gross Sales, what results is the Net Sales. This represents the actual sales that your business made for a given period

- Cost of Sales/Cost of Goods Sold/Cost of Service – refers to expenses/costs that can be directly related to revenue. For example, the cost of acquiring the sold products, or the costs incurred that were necessary for the fulfillment of service. It can also be referred to as “cost of goods sold” for businesses that offer goods, or “cost of service” for businesses that offer services.

- Gross Profit – after deducting the cost of sales from revenue, what you get is your business’s gross profit. It represents how you earn from your sales after considering costs. For example, if you have revenue of $100,000 and a cost of sales of $40,000, then you have a gross profit of $60,000.

- Operating Expenses/OPEX/Selling, General, and Admin (SG&A) Expenses – this line item refers to expenses incurred that are not necessarily directly related to revenue but are still necessary for the operations of a business. For example, salaries and wages, rent expenses, and utilities. Not paying these expenses would mean ceasing operations.

In most audited profit and loss statements, only the total operating expense is presented while the itemized list can be found in the notes to financial statement.

In interim profit and loss statements though where notes to financial states are not usually prepared, you would see all the operating expenses itemized under the operating expense section.

- Operating Profit/Operating Income – this is what you get after deducting the cost of sales and operating expenses from the revenue. It represents the amount of profit that was generated from a business’s operations. This is an important figure for a business’s management as it tells them if operations are going well or not.

- Non-operating Income and Expenses – this refers to income and expenses that are related to non-operating activities. A very prominent example of this is the interest expense related to loans. Other examples include loss or gain from a sale of a long-term asset, dividend income from shares of another business, interest income from money lent, etc.

- Income Tax – refers to the total income taxes paid by a business or an individual. Businesses are usually required to pay income taxes unless they qualified for a tax exemption.

- Net Income/Net Profit – after adding income from all sources (revenue and non-operating income) and deducting expenses from all sources (cost of sales, operating expense, non-operating expense, and income tax), what you get is the net income. It is usually the basis of corporations for declaring and distributing dividends. Whatever is left of the net income after dividends go to retained earnings.

In addition to the information above, you may often hear two terms relating to profit and loss statements:

- Top line – this term refers to the very top line item of a profit and loss statement, which is revenue. If a business’s top line is on an upward trend, then that means that your business’s sales level is increasing. It can also indicate growth. Let’s refer to the illustration below:

Highlighted is the top line item of the profit and loss statement, which is the net revenue.

It is on an upward trend from 2018 to 2020.

This means that the business’s sales level is increasing in the span of three periods.

- Bottom line – this term refers to the bottom line item of a profit and loss statement, which is the net income or net profit. Same as with the top line, an upward trend on a business’s bottom means that it is generating more income as the years go by. Most investors view a business’s bottom line when skimming through its financial statement as it is probably the most important profit and loss statement item for them. Growth in the top line does not always result in growth in the bottom line. Let’s take another look at the previous illustration but this time, the bottom line will be highlighted:

Did you notice that even though the top line is on an upward trend, the bottom line is on a downward trend?

This happens when the increases in costs and expenses exceed the growth in revenue.

Take for example the growth in cost and expenses vs growth in revenue from 2018 to 2019.

Revenue grew by $1,117,000,000 from 2018 to 2019, but cost and expenses grew by $2,398,000,0000 which explains why the bottom line went down even though the top line went up.

How Often Should I Prepare a Profit and Loss Statement?

It depends on you and your business.

You can prepare a profit and loss statement as often as once a week, or you can prepare it once a year.

Public companies however are required to prepare quarterly and annual financial statements, including profit and loss statements.

Preparing profit and loss statements on a monthly basis can be a great way to monitor the financial performance and growth of your business.

This can enable you and your business to address small issues such as increasing costs or expenses, or a slight calculation on budgets.

You can even compare monthly sales and expenses to see in which period your business’s operations are at peak and when it is not.

Creditors often need a copy of your business’s financial statement (including a profit and loss statement) when applying for loans.

Investors will want to take a look at your business’s most recent financial statement before investing their money.

An up-to-date profit and loss statement might be needed before starting a new major project.

What Can the Profit and Loss Statement Tell You?

The Profit and Loss Statement is a great tool for monitoring your business’s financial performance and growth.

With it, you can assess whether your business is generating more revenue periodically.

You can then set sales targets, budgets, and other financial forecasts.

Management can use it to assess the operating efficiency of the business whether sales numbers are within or above target, or expenses are at a manageable level, etc.

They can then decide whether to continue current practices and policies or modify some of them.

Creditors look at a business’s profit and loss statement to assess whether it is capable of paying its debts.

Investors look at it to assess whether it can generate returns to their investments.

Analysts look at it to assess its financial health and derive important financial ratios.

The Limitations of The Profit and Loss Statement

While the profit and loss statement is a useful tool and can provide a great deal of information, it does not tell everything about a business.

It cannot tell you how many assets or liabilities a business has at a certain period – we have the balance sheet for that.

It also does not show how much actual cash is going in and out of the business – something that the cash flow statement can provide.

This is why the profit and loss statement is prepared alongside with the balance sheet, and the cash flow statement.

P&L Statement Under the Cash Accounting Method

Under the cash accounting method, transactions are only recorded whenever cash is involved. It’s a fairly simple method of accounting.

Cash goes in? Record it. Cash goes out?

Record it.

The effect this has on a profit and loss statement is that only cash sales and costs and expenses actually paid with cash are included.

This makes preparing the cash flow statement easy as you don’t have to adjust cash flow from operating activities as it is already in cash basis form.

The disadvantage of the cash accounting method though is it does not account for non-cash transactions.

Sales made on account will not be recorded until payment is paid, expenses will not be recorded until paid – this may make budgeting and target setting a bit complicated.

Also, the profit and loss statement may not accurately represent the growth of the business because of the unrecorded non-cash transactions.

P&L Statement Under the Accrual Accounting Method

The accrual accounting method does things differently from the cash accounting method when it comes to income and expense.

If income is earned or an expense is incurred, a transaction will be recorded.

This is very different from the cash accounting method where transactions are only recorded whenever cash is involved.

The effect this has on a profit and loss statement is that all income and expense transactions are included be it cash sales, credit sales, accrued expenses, or paid expenses.

This makes it more closely represent a business’s actual growth compared to the cash accounting method.

The disadvantage of the accrual accounting method though is that it does not represent the cash flow of the business.

That’s why preparing a cash flow statement for a business that employs the accrual accounting method will take longer compared to one employing the cash accounting method.

Cash flow from operating activities has to be adjusted so that it only reflects cash transactions.

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

IRS.gov "Schedule C" Page 1 . October 4, 2021

IRS.gov "About Schedule C" Page 1 . October 4, 2021

SBA.gov "How to Understand a Profit and Loss Statement" Page 1 . October 4, 2021