Pro Forma Invoice

What is a Pro Forma Invoice

A Pro Forma Invoice is a type of an estimate or a quote sent to a customer or a buyer outlining the details of the product or service, total amount payable and delivery details so that a seller can request for a payment before the goods or services are delivered.

In essence, it is a documented transaction in good faith between both parties to purchase and deliver goods and services.

Understanding Pro Forma Invoices

A proforma invoice is not the same as a commercial invoice and cannot be used for accounting purposes.

Although it is a binding agreement between parties, the terms can change until a final order is confirmed and a commercial invoice is sent out.

The issuance of Pro Forma Invoices is a common practice for international transactions and most specifically, for customs purposes on imports.

Pro Forma Invoices outline the commitment that a seller intends to provide the services or the goods to be delivered.

With international transactions, sometimes there is a lot of going back and forth until the confirmation of an order and if you are dealing with hundreds or thousands of transactions, the time spent going through with changes in the products or services will cost the business time and money.

This scenario is avoided by the issuance of pro forma invoices because it helps companies streamline their sales process.

With agreements confirmed upfront, sales can operate smoothly until delivered.

Special Considerations

In the US, certain documentations have to be met in order for goods to be able to pass through customs.

Their main consideration is that a document must contain information about the buyer and seller, description, quantity and amount of the goods shipped and where the purchase was located.

A commercial invoice lists out all of the information required by customs in the documentation while a pro forma invoice contains just the basic information in order for customs to compute for duties.

Although US customs accept a pro forma invoice to let the shipped goods pass through, companies will still need to present the commercial invoice within 120 days.

Pro Forma Invoice Examples

In business, a sale is recognized when goods are delivered or services have been rendered.

The same scenario happens with a pro forma invoice versus a commercial invoice.

Prior to services being rendered or goods being delivered, a pro forma can be used.

When the goods are delivered and services are rendered, the sale is recorded through a commercial invoice.

For example, a recruitment firm has hired 2 consultants for their client located overseas.

In their agreement, they have stated that the client has to pay 50% of the recruitment fee prior to the recruited consultants arriving at the client’s location.

The issue is that the client will not be able to provide a Purchase Order because the Service Agreement is not yet signed by both parties.

In this case, for the client to process the payment for the recruitment firm, they can request for a pro forma invoice.

However, when agreements have been signed and Purchase Orders have been issued, the client’s accounting department will require a commercial invoice for accounting purposes.

What is in a Pro Forma Invoice?

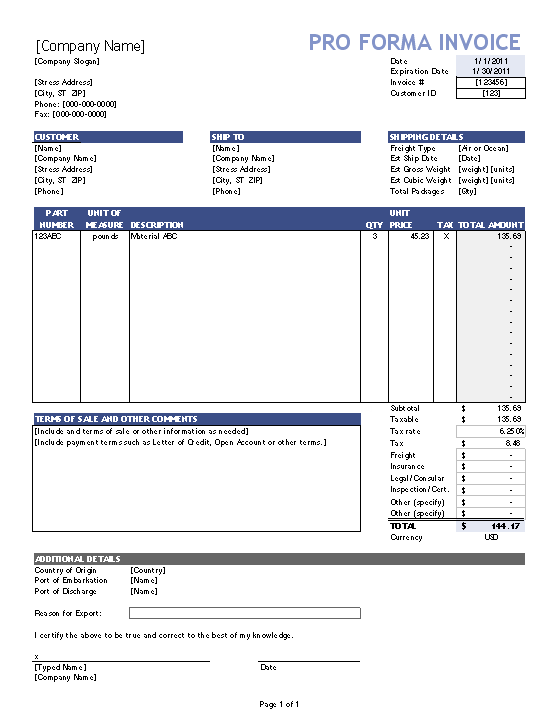

A Pro Forma Invoice will have to include the name “Pro Forma Invoice” on the face of the invoice and must clearly indicate that it is not a tax invoice.

Apart from this, the pro forma invoice shall also include the sales price of the goods or services to be provided to the buyer including other fees such as commissions, taxes, or shipping fees.

Although the pro forma invoice provides an estimate of how much the buyer has to pay in total, it can change.

What it simply indicates is a transaction of good faith between the buyer and seller and an agreement on the charges without the seller making significant changes on it in the future.

Why are Pro Forma Invoices Used?

Companies use Pro Forma Invoices in order to streamline their sales processes and avoid the continuous back and forth between buyers and sellers when finalizing a sales transaction.

Although it functions more closely to an estimate or a quotation, the pro forma invoice provides the closest estimate that a buyer will pay should he decide to go ahead with the product or service.

In international transactions, a pro forma invoice is an essential document for customs purposes on import.

Companies may need a pro forma invoice for different purposes but what it addresses for all business is time saved on negotiations and communications because the terms of the sale have been agreed to upfront.

When are pro forma invoices sent?

Pro Forma Invoices are sent before actual goods are shipped or services are rendered. They act as an agreement or an estimate of what is to be provided and received between both parties and whatever is stated in the pro forma invoice is a binding agreement. However, sellers and buyers need to be aware that a pro forma invoice is not a document that demands a payment but simply outlines the details of the sale transaction that will take place.

There is no definite guideline on how the pro forma invoice should look like and sometimes, it may resemble a tax invoice or a commercial invoice. When receiving a pro forma invoice, the document should clearly indicate that it is a pro forma invoice and that it will not be used for taxation purposes.

How does a commercial invoice differ from a pro forma invoice?

A commercial invoice is typically used by businesses for international transactions and is deemed a final invoice.

They contain information about the seller, the buyer, the location of the purchase, description of the products delivered and services rendered and the total value of the sale.

When goods or services are not fulfilled, a seller cannot send a commercial invoice but can send a pro forma invoice instead.

For customs purposes on imports, the pro forma invoice may be sent provided that the commercial invoice is sent within 120 days.

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

Cornell Law School "Pro forma invoice" Page 1 . November 5, 2021

Purdue University "Service Enterprises Shipping - Materials Management Distribution Center 700 Ahlers Road • West Lafayette, IN 47907-2012 (765) 496-7103 • Fax: (766) 496-2991 Pro Forma Invoice" Page 1 . November 5, 2021