Plowback RatioDefined with Examples, Formula & Calculations

What is the Plowback Ratio?

The financial metric used by companies to show the ratio of the earnings that is not distributed as dividends but are instead retained in the company is called a Plowback Ratio or the Retention Ratio.

This is the opposite of the metric used to compute for the dividends paid called the Dividend Payout Ratio.

Plowback Ratio Formula

There are two ways for companies to compute the Plowback Ratio:

In the formula above, the dividends paid out is subtracted from the Net Income of the company and to get that percentage from the net income, the difference is divided by the net income.

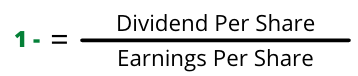

To compute the Plowback Ratio on a per share basis, it can be computed by computing the quotient first of dividend per share divided by the earnings per share.

This quotient is subtracted from 1.

What Does the Plowback Ratio Tell You?

A plowback ratio provides an indication of what management does with the earnings of the company.

When a plowback ratio is high, that means that most of the net income is reinvested in the business, which is typical for companies who are focused on growing it.

But if a plowback ratio is low, that means the management distributes their earnings as dividends.

This can also be an indication that the company has already reached a level of growth and that they are no longer working towards expansion or growth.

When the plowback ratio is zero, that means that companies distribute all of their income as dividends.

The plowback ratio can represent a lot of indication and its interpretation will depend on the preference of investors and management.

Investors might want to invest in companies that pay annual dividends, while some may want to see companies that are growth-focused.

Investor Preference

When investors are deciding which investments they wish to get into, their preferences and goals play an important role.

When plowback ratios are high, this means that companies prefer to retain the earnings of the company and investors who prefer regular dividend distributions (income oriented investors) might not want to invest in such companies.

However, high plowback ratios can also indicate growth and better capital gains in the future, which growth oriented investors prefer.

When companies choose to retain their earnings to use it for the expansion and growth opportunities of the company, dividends are not distributed but that also gives investors an opportunity to also see the growth of their investments.

Impact from Management

The Plowback Ratio is significantly impacted by decisions of the management to distribute dividends or keep them as retained earnings to support the management’s initiative to grow and expand the business.

In the same way, the decisions that a management makes when it comes to the accounting methods used by the business can also directly impact the net income of the company.

It is because of these impacts from management decisions that a plowback ratio can either be high or low.

Example of the Plowback Ratio

The following are the information for Company A, Company B and Company C for the year ended December 31, 2020.

| Company A | Company B | Company C | |

| Net Income | $985,000 | $630,000 | $850,000 |

| Dividends Paid | $700,000 | $150,000 | $375,000 |

Based on the above information, the dividend payout ratio and the plowback ratio can be computed as follows:

Dividend Payout Ratio

Company A – 71% ($700,000 out of a total $985,000)

Company B – 24% ($150,000 / $630,000)

Company C – 44% ($375,000 / $850,000)

Plowback Ratio

Company A – 29% (1- 0.71) or (($985,000 – 700,000) / $985,000)

Company B – 76% (1 – 0.24) or (($630,000 – $150,000) / $630,000)

Company C – 56% (1 – 0.44) or (($850,000 – $375,000) / $850,000)

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

NYU Stern "Equity Valuation Formulas" Page 1 . December 20, 2021

MIT Sloan "Firm valuation" Page 18 - 20. December 20, 2021