Owner’s CapitalDefined along with Formulas & How to Calculate

Owner’s Capital is the accounting term used to represent ownership (for Sole Proprietor or Partnership agreement) or equity shares for investors (for Corporation Entity).

The amount invested is recorded as the owner’s capital or shareholder’s equity.

Owner’s Capital Formula

The formula for Owner’s Capital is:

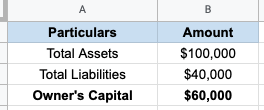

Owner’s capital is calculated by subtracting total liabilities from total assets.

For example, CDS Company’s total reported assets for the year ended 2020 are $100M, while its reported total liabilities are $40M.

The owner’s capital would be $60M ($100M – $40M).

The example shows that the $60M is invested by its owner or investors, while the $40M is funded by third-party creditors like banks, credit unions, etc.

Components of Owners Capital

Common Stock

The investors of this type of share are called common shareholders.

The measurement of its stock price per share is at its par value.

Additional Paid-In Capital (APIC)

The amount paid is greater than the par value of the total acquired shares by the investors.

Additional Paid-In Capital = (Issue Price- Par Value) x Number of Shares Issued

For Example, the Shareholders’ equity information of company SGB is as follows:

Total Common shares issued: 5,000,000 @ 2 par value.

Common Shareholders paid $5 for every share acquisition.

The total paid-in capital would be $15,000,000 (($5-$2) * 5,000,000)).

Retained Earnings

The residual amount can be used for future business transactions.

These amounts are yet to be distributed as dividends to its common shareholders whenever applicable.

It is directly proportional to the profit percentage movement of the company.

As the net income increases, retained earnings also increase or vice versa.

To illustrate, a company has generated a $15,000,000 net income at which $5,000,000 was distributed to its common shareholders.

The remaining $10,000,000 will be recorded in the retained earnings account, which can be used for future purposes.

Accumulated Other Comprehensive Income/Loss

It is a non-typical account and is not a line item in the income statement.

This account affects the shareholder’s equity account to where it should be properly recognized.

The main components of Other Comprehensive Income are actuarial gains or losses, unrealized gains or losses, and foreign currency adjustments.

Treasury Stock

These are stocks that have been repurchased by the company from its shareholder/s.

After the buyback transaction, the shareholders decrease their share percentage.

The two methods of treasury stock accounting are the Cost and Par Value methods.

Example of Owner’s Capital Calculation

Example 1

CDS Company has total assets of $100,000,000 and total liabilities of $40,000.

To compute the owner’s capital:

= $100,000,000 – $40,000

= $60,000,000

Example 2

Manny, the owner of MnM Enterprise, invested $35,000 in its computer shop business while he acquired a business loan amounting to $10,000.

He purchased two laptops for $2,500, tables and office chairs for $500, furniture for $1,500, stock for $ 27,500, and the remaining $13,000 was kept in the bank to support the business operations.

To get the Owner’s Capital, compute using:

= $45,000 – $10,000

= $35,000

Change in Owner’s Capital

- Profit/Loss. The profit or loss directly affects the owner’s capital. If a profit is generated, the owner’s capital increases. When the company incurs a loss, the owner’s capital also decreases.

- Buyback. It is a repurchasing method done by the issuer of the shares (issuing company) to its shareholders. This practice decreases the amount of the owner’s capital.

- Contribution. The company’s capital may increase through new investors or additional shares acquired by the existing investors. A corresponding price of the stocks should be paid for every share acquired.

Advantages and Disadvantages of Owner’s Capital

Advantages

- No burden of Repayment. The owner’s capital does not require standard repayment terms unlike debt funding, where an obligation arises to repay the loan amount based on the agreed terms. The advantage of this is to utilize the time and effort for the company’s future growth.

- No Interference. The owner(s) may focus more on achieving the company’s goal. Unlike when a company has a high debt funding percentage, a lot of related loan transactions may occur and could divide the company’s focus towards its goal. Also, there are relative fees and charges for this type of credit funding.

- No Impact on Interest Rate. Only the capital amount from loan agreements require interest payments. It is a recognizable expense that decreases a company’s net income. The owner’s capital does not entail any interest rates.

- Easy Accessibility to Debt Capital. A high owner’s capital ratio means a positive economic standing. As such, whenever the company wishes to apply for additional capital funding through loans, there is a higher chance that the loan application will be approved.

Disadvantages

- Higher Cost. Capital investment requires a higher cost than debt financing because of the consideration of the opportunity cost. Debt financing can be secured by tangible assets, while the owner’s capital doesn’t. And because of the risks involved in the market, equity investments require a higher return than debts.

- No Leverage Benefit. The benefit of a tax shield is not present in the owner’s capital. Because, unlike debt financing which recognizes interest expense as a reduction to taxable profit, distributed dividends from the owner’s capital do not have the privilege of being recognized as business expenses.

- Dilution. The owner’s capital is subject to the risk of dilution. Whenever there is a new investor/s, the shares percentage of the existing investors will decrease. There is no such dilution process in debt financing.

Conclusion

The owner’s capital is the building block of the business.

It is possible to rely only on the owner’s capital, but some companies may find that debt funding is also beneficial to business growth.

It is better for the company if they know how to achieve the optimal cost of capital management to benefit from capital leverages.

As studies have shown, it is more advantageous for a company to have a higher percentage of debt than equity amount because debts are less risky than the equity source of capital funding.

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

University of Wisconsin "Understanding the Statement of Owner Equity" Page 1 . December 5, 2022

University of Minnesota "Statement of owner's equity" Page 1. December 5, 2022