Net Change FormulaDefined along with Formula & How to Calculate

What is Net Change Formula?

The net change formula differentiates a current period’s computation from its previous amount.

It is commonly used in computing the change of closing prices of equity and bond investments such as stocks, mutual funds, and bonds from the previous closing price to their current closing price.

“Net Change” means the variances of two relevant closing price periods.

In some cases, Net change can be presented through a percentage rate.

The formula to compute Net Change is:

Net Change = Current Period’s Closing Price – Previous Period’s Closing Price

To compute the net change in percentage:

Net Change (%) = [(Current Period’s Closing Price – Previous Period’s Closing Price) / Previous Period’s Closing Price] * 100

Where:

- Current Period’s Closing Price – is the price at the closing period of the analysis.

- Previous Period’s Closing Price – is the price at the beginning of the analysis period.

Explanation

These are the steps to calculate Net Change:

Step 1: Determine the closing price for the current period of the analysis.

Step 2: Determine the previous period’s closing price or the beginning price for the analysis period.

Step 3: Get the difference between Step 2 and Step 1.

Step 4: If the management wants to know the change in percentage terms, the difference in step 3 is divided by the amount in step 2.

How to Calculate Net Change (with Excel Template)

Example # 1: Positive Net Change

The current and previous closing prices of stocks of SMT Company are as follows:

Current Period’s closing price – $52.05

Previous Period’s closing price – $49.75

Computing for the Net Change will be done as:

Net Change = $52.05 – $49.75

Net Change = $3.00

Example # 2: Negative Net Change

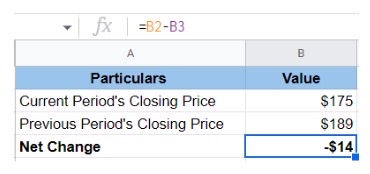

Let’s take a look at the stock prices of CDO Company.

The current closing price is $175, while the previous day’s closing price was $189.

The net change in the stock prices of CDO Company will be computed as follows:

In the given example, the previous closing price is greater than the current period.

It will then result in a Negative Net Change.

Net Change = $175 – $189

Net Change = -$14

Example # 3

A technical analyst wants to know the net change value in the stock price after a month and has collected the following information:

- Current Period closing price: $1,500

- Previous Period closing price (one month prior): $1,400

The net change in value and in the percentage of the stock prices can be computed as:

Net Change = $1,500 – $1,400

Net Change = $100

For the net change percentage calculation:

Net Change (%) = [($1,500 – $1,400) / $1,400] * 100

Net Change = 7.14%

Relevance and Uses

Net change can be a tool when investors want to analyze relevant stock prices.

Net change is the result of the difference between the current period’s closing price and the previous period’s closing price.

By means of this method, investors will be able to gauge the earning rate of stocks or bonds.

It is of big help for technical analysts to monitor price changes and what corrective actions should be done to avoid risks in investing.

The time period of price analysis can be on a daily basis, monthly, or even annually.

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

University of Texas "The Net Change Theorem" Page 1 . August 23, 2022