Goodwillin Finance, Accounting & Investing Explained

When a business acquires another business, the former not only acquires the latter’s assets and liabilities but also the latter’s brand, name, image, and any other value-adding factors that normally cannot be accounted for in financial statements.

These value-adding factors aren’t usually recognized in a business’s financial statements, but people will know if a business has them.

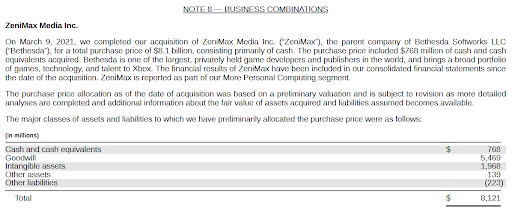

Take for example the acquisition of ZeniMax Media Inc. by Microsoft Corporation for $8.1 Billion.

It was widely agreed that Microsoft Corporation paid more for the net worth of ZeniMax Media Inc., and this reflects in the former’s financial statements:

Source: Microsoft Corporation Form 10-K

As of the date of acquisition, ZeniMax Media Inc.’s net worth amounted to $2.652 billion which is indeed far less than the amount of $8.1 Billion that Microsoft Corporation paid for.

Microsoft saw value in ZeniMax that is far more than what its fair market value states.

But how does Microsoft Corporation account for the excess payment?

Does it record it as a loss?

As an expense?

Well no and no.

Rather, as seen in the illustration above, the excess payment is recorded as Goodwill.

What is goodwill?

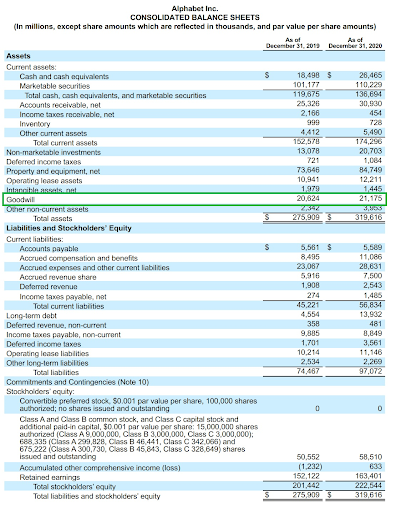

Source: Alphabet Inc. Form 10K

Goodwill is an intangible asset that a business acquires when it purchases or merges with another business, and when the payment made exceeds the fair value of the acquired business’s net assets.

Goodwill represents assets that cannot be separately identifiable such as brand name, brand recognition, competitive employees, etc.

It cannot be self-created nor be acquired on its own.

It can only be acquired through the acquisition of another business.

Also, it cannot be sold on its own.

Goodwill can be thought of as a combination of the value of a business’s brand name, customer relations, loyal customer base, employee-employer relations, business image, and other value-adding factors that cannot be normally accounted for.

For example, you cannot usually put a financial value on customer relations, but you know that having a good one is valuable for a business.

Unlike most intangible assets, goodwill is not amortized as it is perceived to have an indefinite lifespan.

This means that as long as the business exists, goodwill exists too.

However, goodwill needs to be subjected to an impairment test at least once a year.

Going back to our Microsoft Corporation – ZeniMax Media Inc. earlier, we witnessed that Microsoft was willing to pay $8.1 billion for a business that has $2.652 billion net worth.

It’s because Microsoft saw value in it other than the assets already accounted for in the financial statements.

Paying an extra $5.5 billion (which more than doubles ZeniMax Media Inc.’s net worth) to acquire another business isn’t something that any business would do on a whim after all, especially not a business that is as big and successful as Microsoft.

To quote Warren Buffett from his 1983 Berkshire Hathaway (BRKa) shareholder letter:

“Businesses logically are worth far more than net tangible assets when they can be expected to produce earnings on such assets considerably in excess of market rates of return.

The capitalized value of this excess return is economic goodwill.”

Understanding Goodwill: Accounting Goodwill and Economic Goodwill, are they the same?

Goodwill can sometimes be categorized as economic goodwill or accounting goodwill, which can be a bit misleading.

In actuality, they refer to the same thing.

“Accounting goodwill” is actually just recognizing “economic goodwill” in a business’s financial statements.

While goodwill is only recognized in the event of a business combination (when a business acquires another business), a business will inherently create goodwill as it operates over the years.

Goodwill can also be defined as an intangible asset that provides a business with a competitive advantage.

So, creating a loyal customer base, establishing brand identity, improving customer relations, providing quality service, producing competent employees – all of these will create goodwill for a business.

Just take a look at one of the most popular fast-food chains – McDonald’s.

They are known for fast service, affordable food, and their brand identity.

While their financial statements can show us a quantitative measure of their net worth, it can be argued that their value is way more than what the numbers show.

Which one are you likely to buy: a cheeseburger meal from McDonald’s or a cheeseburger meal from a random burger joint that just popped up recently?

Over the years, there have been competing views on how to account for goodwill.

Currently, goodwill is no longer amortized, but that wasn’t the case before the rule change in 2001.

Some think that this rule change is unnecessary and goodwill should be amortized.

Others even think that goodwill is irrelevant.

That it shouldn’t be accounted for at all!

But whatever the viewpoint is, no one can deny the value of good customer relations, an established brand image, great employer-employee relations, all of which could help a business in raking in more sales.

How to compute Goodwill

To compute for goodwill, we use the following formula:

Goodwill = Purchase Price – (FMV of total assets – FMV of total liabilities)

Where:

Purchase Price refers to the amount paid by the acquiring party (acquirer) to acquire/purchase the target business (acquiree).

FMV of total assets refers to the fair market value of the identifiable assets of the acquiree.

FMV of total liabilities refers to the fair market value of the liabilities of the acquiree.

The formula for computing goodwill is fairly straightforward but it can be complex in practice, particularly gathering the figure for the components of the formula.

The purchase price is probably the easiest to get, but the FMV of assets and liabilities may take some time.

To familiarize ourselves with the formula, let’s have a little exercise:

Company ZT acquired company GA for $7,000,000.

As per valuation, the FMV of company GA’s total assets was assessed to be $8,000,000, while the FMV of its liabilities was assessed to be $2,500,000.

Let’s compute for the goodwill acquired by company ZT in this acquisition:

Goodwill = Purchase Price – ( FMV of total assets – FMV of total liabilities)

Goodwill = $7,000,000 – ($8,000,000 – $2,500,000)

Goodwill = $7,000,000 – $5,500,000

Goodwill = $1,500,000

As per computation, company ZT acquired goodwill of $1,500,000 on top of company GA net assets.

This goodwill will be recorded in company ZT’s books as an intangible asset.

Let’s take it up a notch with another example:

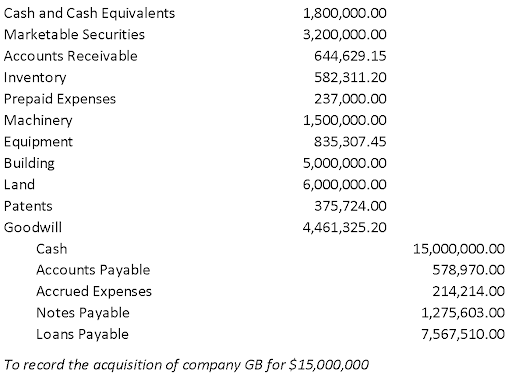

Company AS acquired the entirety of company GB for $15,000,000.

Company AS is about to record the acquisition in its books, but it still has to compute for the amount of goodwill acquired from the acquisition, if there is any.

Upon the valuation of company GB’s assets and liabilities, the following data was acquired:

Let’s compute for the goodwill to be recorded by company AS.

First, we need to get the FMV of the company GB’s total assets.

From the table above, we identified that the following items as company GB’s assets: cash and cash equivalents, marketable securities, accounts receivable, inventory, prepaid expenses, machinery, equipment, building, land, and patents.

We add the FMV of these assets together to arrive at our “FMV of total assets” figure:

FMV of total assets = $1,800,000 + $3,200,000 + $644,629.15 + $582,311.02 + $237,000 + $1,500,000 + $835,307.45 + $5,000,000 + $6,000,000 + $375,724

FMV of total assets = $20,174,971.80

Company GB’s total assets have an FMV of $20,174,971.80.

Next, we compute the FMV of company GB’s total liabilities.

From the table above, we identified the following items as company GB’s liabilities: accounts payable, accrued expenses, notes payable, and loans payable.

We add up the FMV of these liabilities to arrive at our “FMV of total liabilities” figure:

FMV of total liabilities = 578,970 + 214,214 + 1,275,603 + 7,567,510

FMV of total liabilities = $9,636,297.00

Company GB’s total liabilities have an FMV of $9,636,297.00.

Since now we have all the figures need, we can now compute for goodwill:

Goodwill = Purchase Price – (FMV of total assets – FMV total liabilities)

Goodwill = $15,000,000.00 – ( $20,174,971.80 – $9,636,297.00 )

Goodwill = $15,000,000.00 – $10,538,674.80

Goodwill = $4,461,325.20

As per computation, company AS has acquired goodwill of $4,461,235.20 as a result of its acquisition of company GB.

In its journal, the entry for this transaction would look like this:

A simple process of computation right?

But be aware that this isn’t as simple in practice where the fair market value of a business’s assets and liabilities are not always readily available.

Negative Goodwill

Negative goodwill occurs if the purchase price is less than the FMV of the acquired business’s (acquiree) net worth.

Negative goodwill can also be considered a discount on a business combination.

It almost always favors the acquiring business (acquirer) as it means that they purchased another business at a significantly lower price.

In fact, negative goodwill is recorded in the acquirer’s books as “gain from bargain purchase” and shows in its income statement as non-cash income.

A business that is in financial distress or has declared bankruptcy, and has no other option but to liquidate its assets at a significantly lower price than the FMV is when negative goodwill occurs.

It is almost always unfavorable for the selling party (acquiree).

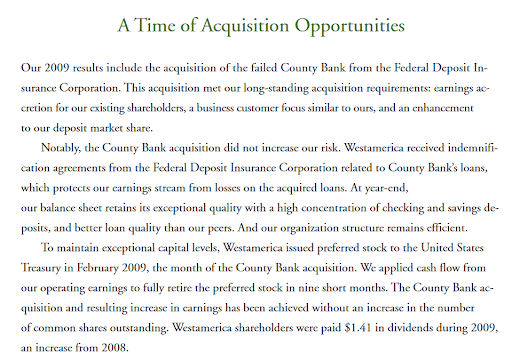

A real-life example of negative goodwill is the 2009 acquisition made by Westamerica Bancorporation.

In 2009, Westamera Corporation acquired County Bank for almost nothing which resulted in negative goodwill of $48.8 million.

This acquisition is mentioned in Weastamerica Bancorporation’s 2009 annual report:

Source: 2009 Annual Report of Westamerica Bancorporation

And the $48.8 million negative goodwill that resulted from the acquisition is reflected in Westamerica Bancorporation’s consolidated statements of income:

Source: Westamerica Bancorporation’s 2009 Annual Report

While negative goodwill results in a “gain” on the part of the acquirer, it must still be wary of the business it acquired.

If not monitored well, it can result in greater losses in the long run.

Purchased Goodwill vs Internally Generated Goodwill

Purchased goodwill refers to goodwill acquired from the acquisition of another business.

If the purchase price exceeds the FMV of the acquired business’s net worth, the excess is to be recorded as goodwill in the acquiring business’s books.

Internally generated goodwill (or inherent goodwill) is something that a business builds over time as it operates.

If the business promotes good business practices, then it will naturally be building up positive goodwill.

For example, if a business keeps on delivering quality products and services, then it will inherently build up goodwill among its customers.

If it treats its employees well, then it will build up goodwill among its employees.

The goodwill account that we see in a business’s financial statement is a representation of the goodwill acquired from the purchase of another business, in other words, purchased goodwill.

So what about the goodwill that a business inherently generated over time?

Is it not accounted for in a business’s financial statements?

The issue with recording internally generated goodwill is that you can’t put a number on it.

Yes, it has value, but the question is “how much value should I put on it?”.

According to IAS 38, goodwill can only be recorded as an intangible asset if (1) it is probable that the future economic benefits that are attributable to the asset will flow to the entity; and (2) the cost of the asset can be measured reliably.

While internally generate goodwill meets the first criteria, it does not meet the second criteria.

This is why it cannot be recognized in a business’s books.

But don’t worry!

Even though internally generated goodwill cannot be recognized in your business books, its value is still there.

One can even say that it can influence your sales numbers.

There’s a reason why popular brands such as McDonald’s, KFC, and Wendy’s are as big as they are now.

And it’s not just because of the assets recorded in their books!

Importance of Goodwill in Business

While internally generated goodwill is not recorded in a business’s books, it’s still important as it increases a business’s value.

Take for example See’s Candies which had a net worth of $8 million.

Due to a lot of contributing factors one of which is a favorable reputation with its customers, See’s Candies was able to constantly generate net earnings of $2.5milion which was roughly equal to a 25% return.

This was rare for a business like it at the time, which was noticed by Berkshire Hathaway Inc.

It ultimately resulted in Berkshire Hathaway Inc. purchasing See’s Candies for $25 million which is significantly more than its net worth of $8 million.

Internally generated goodwill is not immediately seen in a business’s financial statements, but you would know if it has one.

Brand loyalty, standing out against its competition, great brand recognition – all of these are just some of the benefits of having goodwill.

There’s a reason why expensive brands such as Rolex, Prada, Hermes, etc. have a loyal customer base despite the price tag.

Goodwill can also increase a business’s value.

If customers recognize the value of your business’s goodwill, chances are, investors would too.

As such, it might make them more likely to invest in your business.

Creditors too.

If creditors notice the value of your business’s goodwill, they will more likely grant you credit should you need it.

Purchased goodwill is important too, but in a different way than internally generated goodwill.

Since it is essentially a “premium” that came from the acquisition of another business, it’s important to monitor it so that it accurately represents the value of the acquired business.

It is more important for the owners and investors because they want to assure that they paid the right amount for the business that they purchased.

Let’s go back to the Microsoft-ZeniMax example we had earlier.

In this business combination, Microsoft Corporation essentially paid a premium of $5.5 billion (the amount recognized as goodwill) to wholly own ZeniMax.

If you are a shareholder or an investor of Microsoft Corporation, you’ll be concerned as to whether the premium paid is worth it.

Let’s hope that the deal works out for them.

Impairment of Goodwill

According to IAS 36 — Impairment of Assets, goodwill should be tested for impairment annually or whenever there is an event that can cause the fair market value of goodwill to drop below its book value.

Some examples of events that can trigger the impairment of goodwill are:

- Economic recession

- Unanticipated competition

- Loss of a key customer

- Stock market downturn

- Negative cash flows from operations

- Legal implications

- Change in key personnel such as CEO or president

- The purchased business is deemed unable to demonstrate financial results that were expected from it at the time of its purchase

If it is confirmed that there is impairment, goodwill should be adjusted to reflect such.

A fitting real-world example of goodwill impairment is when AOL Time Warner Inc. recorded an impairment loss of $45 billion.

It is reflected in its income statement as follows:

Source: AOL Time Warner Inc. 2009 10K

To put into context AOL acquired Time Warner on January 10, 2001 (two years before the impairment) which generated $127 billion of goodwill in AOL’s books.

After just two years, a third of that goodwill was written-off because of impairment.

Goodwill vs Other Intangible Assets

Since goodwill is an intangible asset, it shares some similarities with other intangible assets:

- It does not have a physical substance

- It can be measured reliably

- It is expected to provide economic benefits to the business

Unlike other intangible assets though, goodwill cannot be purchased or sold on its own.

Its existence is attached to the business and it cannot be separated.

It can only be recorded in a business’s books through the acquisition of another business where the purchases price exceeds the FMV of the acquired business’s net assets.

Although goodwill can be internally generated, the only goodwill that can be recognized in a business’s books are those that are acquired from business combinations.

Suppose a business has not been involved in a business combination yet, its intangible assets will only consist of identifiable items, all of which the cost can be measured reliably.

Intangible assets such as patents, trademarks, copyrights, and software licenses are all recorded in a business’s books by the cost of their acquisition.

Goodwill is more of a collection of intangible assets that cannot be identified or quantified on their own.

Things such as brand recognition, a loyal customer base, quality service, brand loyalty, competent employees – these all count as goodwill.

Most intangible assets are amortized over their perceived useful life, but goodwill cannot be amortized since it is presumed to have an indefinite life.

Instead, a business is required to subject goodwill to an impairment test at least once a year.

This is so that the goodwill account shown in a business’s financial statements accurately represents the value of the acquired business.

Limitations of Goodwill

Goodwill is inherently difficult to put a value on. Some even consider that the recording of goodwill that arises from the acquisition of another business to be an accounting workaround.

The fact that there are differing opinions on goodwill makes its valuation highly subjective.

The purchase price agreed upon by the parties in a business combination can either be high or low and as a result, can inflate the value of the acquired business (and consequently, goodwill) for more than what it really is.

The acquiring party is essentially taking a risk when purchasing another business for more than its fair market value.

If it turns out that the acquisition is grossly overpriced, then the acquiring party will be suffering a huge loss which can not only affect its financial health but could also potentially harm its own internally generated goodwill.

Another risk that can come with goodwill accounting is that a highly sought successful business could turn to be a flop as a result of the business combination.

Just take a look at how the AOL – Time Warner Inc. merger turned out. AOL was one of the biggest names at the time, even valued to be more than $200 billion.

It was considered to be the biggest business merger at the time.

Then two years later, the merger resulted in a net loss of $98.7 billion (which included $45.5 billion of impairment to goodwill).

To this day, it is still considered to be the worst merger in history.

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

IRS.gov "Amortization of Goodwill and Certain Other Intangibles" IRS pdf. October 1, 2021

Cornell Law School "Amortization of goodwill and certain other intangibles " Page 1. October 1, 2021

Berkshire Hathaway "Shareholder Letter" Page 1. October 1, 2021