EV to AssetsEnterprise Value Defined with ratio and examples

The EV or enterprise value to assets ratio is a crucial measure of valuation for analyzing the value of a company in comparison to its total assets.

This is particularly valuable for comparing multiple companies in the same sector as it offers a view of how a given enterprise stands against its competitors in regard to capital structure.

By comparing enterprise value which represents the value of a company, against its assets, investors and analysts can glean a significant idea of how assets drove a company.

Additionally, by comparing enterprise value itself which roughly represents the purchase price of a company through determining market capitalization and adding in the market value of debt minus cash and cash equivalents, it is possible to determine whether a company is under-or over-valued.

As a result, EV to Assets is a valuable financial metric for investors.

Calculating Enterprise Value

Enterprise value and the ratios that can be calculated using it form an important foundation for stock analysis.

Using enterprise value or its ratios, an investor or analyst can both calculate the cost of purchasing a business and compare this value with other companies in similar industries.

The formula for calculating enterprise value is:

Enterprise Value equals a company’s market capitalization plus its total debt and minority interest, minus cash and cash equivalents.

In order to calculate this, an investor would find a company’s market capitalization, which is the total number of fully diluted shares outstanding times the share price, including all convertible securities and options.

Added to the resulting number would be the total market value of all the company’s debt, both short- and long-term.

This includes preferred stocks, which are a form of security that hold both the features of equity and debt

. Because of this, they are sometimes referred to as hybrid securities and are treated so in the event of an acquisition.

They will typically be repaid and are, for the purposes of EV, treated as a debt.

Minority interest refers to the portion of subsidiaries that are owned by minority shareholders.

This is because once the company has been acquired, all of its financials will be merged with the acquiring company’s, including all companies in which the acquired company held a stake of 50% or greater.

As a result, all cash flows, revenue, and expenses of these subsidiaries of the acquired company must be accounted for in order to provide an accurate value for acquiring a company.

This is why minority interests should be added to market capitalization and debt when calculating EV.

Once debt and minority interest have been added to market capitalization, the result thus far will be taken minus all cash and cash equivalents.

The cash held by the company is subtracted because what is essentially being calculated is the purchase price for the company, and any cash it holds would go to the buyer, offsetting in part the debt, which the buyer would also now be responsible for.

The same applies to all cash equivalents, such as treasury bills which can easily and quickly be converted into cash.

This can be better understood by considering a comparison of the enterprise value of two companies.

Company A has a higher enterprise value than Company B, meaning that if an investor were to attempt to acquire the company, they would have to pay a higher price to do so.

Another situation that can potentially arise is a negative EV, which can occur when a company holds a particularly large reserve of cash or cash equivalents that outweigh the company’s debt and has not been accounted for in the market valuation of the company’s stock.

As a result, EVs can reveal a significant amount of information concerning a company’s capital structure, making it a valuable tool with which to compare different companies.

One vital component of enterprise value is market capitalization.

Market capitalization is the market value of a company that is publicly traded. It can be computed by multiplying the company’s share price by the total number of outstanding shares it has.

As an example, suppose Company X has 5,000 outstanding shares, and the share price is $100.

Market capitalization = Number of shares x share price

Market capitalization of Company X = 5,000 x $100 = $500,000.

This means that the price of acquiring Company X would be $500,000. This is not necessarily the intrinsic value of Company X, just the upfront price for the company.

What Is the Importance of Enterprise Value?

Market Capitalization does give the price of acquiring a company, but enterprise value actually gives a more complete, accurate, and dependable view of the total value of a company.

With EV, the estimation of a company’s value includes the full equity and debt, which can greatly affect the actual value if the company were to be acquired, whereas market capitalization fails to include this.

This provides a far more realistic estimation of the amount of money that would be required in order to acquire a company.

The formula for EV includes both cash as well as debt, and both will have a direct result on the resulting cost of acquiring a company.

Additional debt will increase the cost of buying a company and, as a result, will be added to market capitalization in the EV calculation.

In contrast, because cash is an asset that will be retained by the acquirer, it is subtracted from EV in the calculation.

As a result, companies with the same market capitalization may have vastly different enterprise values.

Consider, for instance, if Company A had a market capitalization of $2,000,000, with cash reserves of $200,000, and $300,000 in debt, whereas Company B has the same market capitalization of $2,000,000, cash reserves of $400,000, and $100,000 of debt.

By using the EV formula, we can see what each of these companies would cost to acquire.

Company A would have an EV of $2,100,000 found by adding $2,000,000 of market capitalization, plus $200,000 cash, and minus $300,000 in debt.

Company B would have an EV of $1,700,000 based on $2,000,000 in market capitalization, plus $100,000 in debt, minus $400,000 in cash.

It is clear to see that Company A would cost more to acquire than Company B.

EV to Assets Ratio

An asset is a resource with an economic value that is possessed by a company and is expected to help generate future benefits.

Assets are recorded on a company’s balance sheet and may help to generate cash flows, reduce expenses, or provide other current or future benefits.

Unlike market capitalization, which is constantly shifting with market trends, assets often provide a relatively stable value.

As a result, investors may choose to consider a company’s assets in making investment decisions as a greater guarantee against a total loss.

This is where the EV to-asset ratio comes in.

This valuation metric compares a company’s total value against all of its assets.

This can provide an effective method for comparing the stocks of different companies in the same sector against each other.

As a result, it is an important ratio for equity investors and analysts.

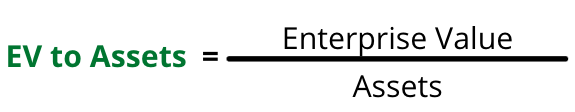

The formula for the EV to assets ratio is:

As an example of this formula in action consider a company with the following financial values:

- Market Capitalization: 700,000 (70,000 outstanding shares * Share Price $10 = $700,000)

- Assets: $150,000

- Total Debt: $60,000 (short-term debt of $15,000 + long-term debt of $45,000)

- Cash & Cash Equivalents: $40,000

From this we can calculate the EV of this company:

Market Capitalization $700,000 + Total Debt of $60,000 – Cash & Cash Equivalents of 40,000 = Enterprise Value of $720,000

Now, we can see that the company possesses an EV of $720,000, and with this information and the assets above, we can calculate the EV to assets ratio.

EV of $720,000 / Assets of $150,000 = EV to Assets Ratio of 4.8

With this result, we can see the company has a 4.8 ratio of value in relation to the value of its assets.

What’s Considered a Good EV to Assets Ratio?

If a company has a high EV to assets ratio, it means that the business is overvalued as compared to the value of the company’s assets.

This ratio looks at investment from the perspective of the investment’s capital structure.

This allows investors to better understand whether or not the face value is good.

So, this ratio is good for giving investors a good idea of an investment’s value, particularly for investments in an asset-driven industry.

This makes the EV to assets ratio more useful in asset-driven businesses where the return on assets is basically constant.

The investors will be looking at companies from their capital structure.

This will allow investors to get an idea of whether or not the face value is priced appropriately to make it a good purchase or if the company is in debt.

This ratio can help give investors a good limit for asset-driven companies.

In fact, the EV to asset ratio is an important determinant and an excellent way to get a good understanding of the value of asset-driven businesses.

The EV to asset ratio can also help to gauge the future cash flow prospects of a company that investors might want to invest in.

The EV to asset ratio gives a basically accurate but different view of a business’s value by comparing its actual value to its assets’ value.

Companies can also use this ratio as a tool to analyze their standing in the industry they are in based on their structure.

There are some difficulties in using the EV to assets ratio.

One of these problems is that assets are not always classified or defined in the exact same way, and this can affect this ratio, thus sometimes giving people an inaccurate view of a company’s value.

Although, individuals with more experience and knowledge in this area can look at the assets and recognize any exaggerations or find any hidden assets, which typically occurs with intangible assets when it comes time to estimate their value.

In situations where this does happen, it can be difficult to continue to use the EV to asset ratio.

The depreciation of an asset’s value can also be a problem when using this ratio, thus making it difficult to depend on the EV to assets ratio.

However, the EV to assets ratio can still be one of the most useful financial metrics among the enterprise valuation multiples for investors.

It’s just important to keep in mind its difficulties, such as hiding assets, exaggerating the value of assets, or the difficulty of calculating the ratio accurately when considering the value of depreciation.

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

NYU "Financial Ratios and Measures" Page 1 . August 11, 2022

Harvard Business School "HOW TO VALUE A COMPANY: 6 METHODS AND EXAMPLES" Page 1 . August 11, 2022