Degree of Operating LeverageDefined & Explained for Business & Finance

What is the Degree of Operating Leverage?

The Degree of Operating Leverage (DOL) is a financial ratio that is used by management in order to ascertain the efficiency of the use of a company’s fixed and variable costs to generate income.

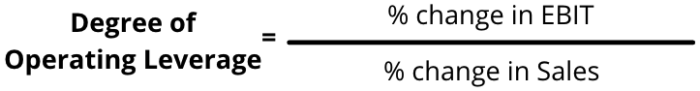

It also refers to the measurement of how a company’s EBIT or operating income changes in respect to the changes in sales.

When the DOL ratio is used effectively, it can assist the management in determining the impact that changes in sales can have on the overall profit of the company.

Formula and Calculation of Degree of Operating Leverage

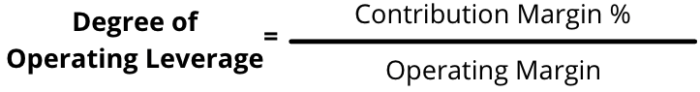

There are different ways to compute for the DOL depending on the information that is readily available with the company.

Since the operating leverage is also closely related to the cost structure of the company, the other formula to compute for the DOL can be taken from the Contribution Margin of the firm.

Where Contribution Margin = Total Sales – Variable Cost

What the Degree of Operating Leverage Can Tell You

The Degree of Operating Leverage, other than showing the ratio at which the operating profit will change according to changes in sales, is also able to show the percentage of the fixed cost against the total cost.

The result – high or low operating leverage – will be able to show management how changes in the sales can affect the EBIT of the company in respect to the variable and fixed costs.

High Operating Leverage

There are several indications that is presented to the management when the Degree of Operating Leverage is high:

- The proportion of a company’s fixed cost is high and thus high increases in the sales of the company can result in outsized changes in the profits.

- The EBIT or operating income is highly sensitive to the changes in sales, assuming all variables remain constant.

Low Operating Leverage

- In contrast to high operating leverage where the proportion of fixed cost is high, low operating leverage indicates that the proportion of variable cost is high – sales do not have to increase that much in order for the fixed costs to be covered but at the same time, companies will only earn lesser profit for each sale that they make.

Example of How to Use Degree of Operating Leverage

As an example, suppose Company ABC has the following information:

| 2014 | 2015 | |

| Sales | $675,000.00 | $825,000.00 |

| Operating Expenses | $490,000.00 | $585,000.00 |

To compute for the Degree of Operating Leverage using one of the formulas above:

The percentage change in EBIT can be calculated using the following formula:

(2014 EBIT) $675,000 – $490,000 = $185,000

(2015 EBIT) $825,000 – $585,000 = $240,000

% of Change in EBIT = ($240,000 / $185,000) – 1

% of Change in EBIT = 29.73%

% of Change in Sales = ($825,000 / $675,000) – 1

% of Changes in Sales = 22.22%

Degree of Operating Leverage = 1.34%

The Difference Between Degree of Operating Leverage and Degree of Combined Leverage

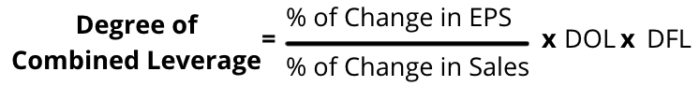

The DOL measures the effect that a change in sales has on a company’s operating income while a Degree of Combined Leverage (DCL) is used to measure the effect that the DOL and DFL (Degree of Financial Leverage) have on the Earnings Per Share (EPS).

When companies have higher DCLs, they are considered to be riskier firms as compared to those with low DCLs because it means that they have higher fixed costs.

The formula to compute for the DCL is:

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

NYU Stern "Credit Spreads, Consumer Sentiment and Operating Leverage" White Paper. January 4, 2022

Virginia Tech "Effect of Operating and Financial Leverage on Firm's Risk" Page 1 . January 4, 2022

Columbia University "Profitability Decomposition and Operating Risk" White paper. January 4, 2022