Cash RatioDefined with Formula & More

What is the Cash Ratio

The Cash Ratio is one of the liquidity ratios that companies compute in order to determine a company’s liquidity based on their cash and cash equivalents which is considered to be a more conservative way of computing it.

It is used to measure a company’s ability to meet their short-term obligations based on their most liquid assets.

When lenders check the amount of loan they can approve, a cash ratio is highly important in influencing their decision.

Because the analysis is only based on the current assets and current liabilities, the cash ratio will give investors, analysts and creditors an idea of how much of the current liabilities will be covered by the current assets of the company in case it were to go out of business.

Understanding the Cash Ratio

Cash Ratio provides a financial measure of how short-term liabilities will be paid off by highly liquid assets of the company.

Compared to other liquidity ratios like the Current Ratio and Quick Ratio, the Cash Ratio is a more conservative measure.

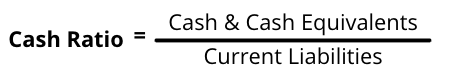

The Cash Ratio formula is:

Where:

Cash & Cash Equivalents = legal tenders, demand deposits, assets that can be readily converted to cash such as treasury bills, savings accounts and money market instruments.

Current liabilities are short-term obligations that must be paid within one year, including items like accounts payable and accrued expenses.

Unlike the Current Ratio and Quick Ratio, the Cash Ratio is different from these two because of their numerators – Cash Ratio only includes cash and cash equivalents.

Other assets such as Accounts Receivable, Inventory and fixed assets are not included because they are not readily convertible to cash and will require time and effort to convert them.

What Does the Cash Ratio Reveal?

The Cash Ratio is a financial measure of liquidity to determine how much of the short-term debts are going to be covered by the cash and cash equivalents immediately without having to liquidate other assets.

When the ratio is more than 1, it means that the company is liquid enough to pay their current liabilities.

Equal to 1 means that the cash and cash equivalents are just enough to pay the short-term debts.

For example, the Balance Sheet of Company H shows the following information:

| Cash | $75,000 |

| Cash Equivalents | $60,000 |

| Accounts Receivable | $23,000 |

| Inventory | $12,000 |

| Property, Plant & Equipment | $85,000 |

| Accounts Payable | $9,800 |

| Short-term Liabilities | $70,000 |

| Long-term Liabilities | $200,000 |

Based on the above information, the Cash Ratio is 1.93 (($75,000 + $60,000) / $70,000).

Greater than 1

When the cash ratio is greater than 1, this indicates that the company’s cash and cash equivalents are enough to cover their short-term obligations and more.

This means that a company is highly liquid.

While a high cash ratio may be beneficial to the company, this can signal that assets of the company are not effectively utilized and that cash is just left in the company’s account and not used to further their financial growth.

Less than 1

In the above example, suppose the short-term liabilities is $200,000, the Cash Ratio will have a different outcome.

It will be 0.675 ((75,000 + 60,000) / $200,000).

A Cash Ratio that is less than 1 means that the company is not liquid enough to cover their short-term liabilities.

Limitations of the Cash Ratio

Cash Ratios are important liquidity indicators of a company but not always used in their financial analysis because while a good cash ratio is indicative of the capacity of a company to pay for their short-term debts, it can also mean that the company is not using their assets effectively for the growth of the business.

Where cash ratios make the most sense is when they are compared to companies of the same industry and when used to compare a company’s past cash ratios.

When companies look at liquidity problems, a cash ratio will be able to help them spot financial difficulty right away.

But low cash ratios does not always mean a problem for the company – it could also be that the cash has been used for the company’s expansion and that company policy states that the business does not hold large amounts of cash reserves.

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

Iowa State University "Financial Ratios" Page 1 . January 18, 2022

Southern Utah University "Balance Sheet Ratios" Page 1 - 2. January 18, 2022

Virginia Tech "A Comparison of the Current Ratio and the Cash Conversion Cycle in Evaluating Working Capital Cash Flows " White paper. January 18, 2022