Cash Conversion Cycle

Purchase materials/goods for sale (be it cash or on credit), convert materials to sellable goods, sell the goods, receive cash or record accounts receivable, collect payment on accounts receivable, pay accounts payable… these are activities that businesses run through during their operations.

This is what a typical operating cycle of a business is like after all.

As a business owner, or even as an operations manager, you would want to know how long it takes for this operating cycle to complete so that you can know whether or not improvements should be made.

That’s where the computation for a business’s cash conversion cycle comes in.

What is a Cash Conversion Cycle (CCC)

The cash conversion cycle (CCC), also referred to as the net operating cycle, measures the time it takes for a business to convert its inventory into cash.

It is measured in days, and shows how long each dollar of your cash is tied up to your operating activities before it is turned into cash received.

To illustrate a very simple picture, let’s imagine Tom’s lemonade stand.

Every day, Tom wakes up early to buy lemons from the nearest market.

When he goes back home, he then turns all of his bought lemons into lemonade and then proceeds to sell them.

At the end of the day, Tom manages to sell all of his lemonade.

In this very simple example, Tom was able to purchase his inventory, convert such inventory into sellable goods, sell such goods, and collect money all in the same day.

All this means is that Tom’s lemonade stand has a cash conversion cycle of one day.

It’s to be reiterated that the above example is a very simple one.

Most businesses are not as simple as Tom’s lemonade stand.

There’s the existence of purchases on credit, sales on credit, inventory not being converted to sellable goods on day one, goods that will only be sold after a certain amount of time… all of these and more can affect a business’s cash conversion cycle.

But don’t worry, it may not be as simple as Tom’s lemonade stand, but computing for a business’s cash conversion cycle isn’t that complicated.

Components of a Cash Conversion Cycle

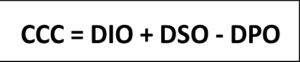

The formula for computing a business’s cash conversion cycle is:

Where:

CCC = Cash Conversion Cycle

DIO = Days Inventory Outstanding

DSO = Days Sales Outstanding

DPO = Days Payables Outstanding

As can be seen from the formula above, the cash conversion cycle is actually a combination of three financial ratios: Days Inventory Outstanding (DIO), Days Sales Outstanding (DSO), and Days Payable Outstanding (DPO).

Days Inventory Outstanding

Inventory usually takes days for it to be sold.

Even more so for manufacturing businesses as they need time to process their inventory into sell-able goods.

The Days Inventory Outstanding (DIO) measures the average time it takes for a business to convert its inventory into sales.

DIO is arrived at by using the formula:

- The average inventory is usually arrived at by computing the average of the beginning and ending balances of the inventory. There’s another approach where the ending balance of inventory is used instead of the average inventory

- Cost of goods sold (also referred to as cost of sales) can be derived from the income statement.

- Number of days in period refers to the number of days in the period that is being examined, such as a full accounting period (1 year), a quarter, a month, or a week. If the period is a year, the number used is usually 365 or 360

A high figure in DIO would mean that inventory takes a long time for it to be sold.

It may mean that the business is inefficient in converting its inventory into sales.

However, this isn’t always true as there are businesses in industries that have products that have a long manufacturing process, which naturally results in high DIO.

For example, the manufacturing process for building a car will significantly take more time when compared to the manufacturing process of simple objects (e.g. pencils, erasers, pens).

Days Sales Outstanding

Sales can either be Cash Sales or Sales on Account/Credit Sales (which records Accounts Receivable).

For cash sales, cash is immediately received when a sale is made.

For sales on account, however, cash is received only when collected after a certain amount of time has passed, depending on the credit term given to the customer.

A business can have both cash sales, and sales on account.

Days sales outstanding (DSO) measures the time it takes for a business to collect payments on its sales on accounts/credit sales.

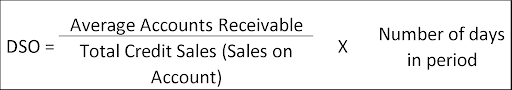

DSO is arrived at by using the formula:

- Average accounts receivable is arrived at by computing the average of the beginning and ending balances of the accounts receivable. Another approach is to use the ending balance of the accounts receivable instead of using the average

- Total credit sales refers to all sales on accounts and can be arrived at by deducting cash sales from the total sales

- Number of days in period refers to the number of days in the period that is being examined, such as a full accounting period (1 year), a quarter, a month, or a week. If the period is a year, the number used is usually 365 or 360

Having a low DSO figure would be ideal. It would mean that the collection of payments for sales on accounts takes a short amount of time.

Having a high DSO might mean inefficiency in the collection of accounts receivable.

It could be that the credit terms for credit sales are too long, customers don’t pay on time, or management is just inefficient in collecting.

Days Payable Outstanding

To restock a business’s inventory, purchases would have to be made. Purchases, like sales, can be made in cash or on account (which records Accounts Payable).

Days payable outstanding (DPO) measures the average time it takes for a business to pay its payables, such as bills, and credit owed to its suppliers.

Unlike the previous two components of the CCC which involved the efficiency of conversion of non-cash assets into cash, DPO focuses more on the management of cash outflows.

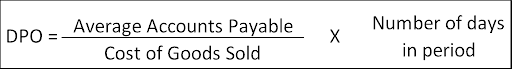

DPO is arrived at by using the formula:

- Average accounts payable is arrived at by computing the average of the beginning and ending balances of the accounts payable. Another approach is to use the ending balance of the accounts payable instead of using the average

- Cost of goods sold (also referred to as cost of sales) can be derived from the income statement.

- Number of days in period refers to the number of days in the period that is being examined, such as a full accounting period (1 year), a quarter, a month, or a week. If the period is a year, the number used is usually 365 or 360

Having a high figure in DPO would mean that the business may have some huge bargaining power, and in turn, can get longer and more lax credit terms.

It also means that the cash they don’t use for paying can instead be utilized to maximize profits, such as using it to purchase more goods to be sold.

However, having a high DPO could also mean that the business is slow in paying its payables, which could have been done on purpose (may not be a good look for future credit purchases), or maybe the company is suffering mismanagement of cash.

So now that we have discussed the components of a cash conversion cycle, let’s illustrate it with an example.

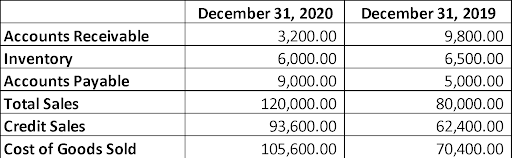

From the financial statements of AT company, we extracted the following data:

For this example, we will compute for AT company’s cash conversion cycle for the year ended December 31, 2020, and the number of days in period we will be using would be 365.

Let’s first compute for the days inventory outstanding (DIO):

DIO = (Average Inventory/Cost of Goods Sold) * Number of Days in Period

DIO = ((6,500 + 6,000)/2)/105,600 * 365

DIO = 21.602 or 22 days

As per the above computation, AT company take approximately 22 days to convert its inventory into sales.

Next, let’s compute for the days sales outstanding (DSO):

DSO = (Average Accounts Receivable/Credit Sales) * Number of Days in Period

DSO = ((9,800 + 3,200)/2)/93,600 * 365

DSO = 25.347 or 25 days

This means that AT company takes approximately 25 days to collect on its credit sales.

We will now compute for the days payable outstanding (DPO):

DPO = (Average Accounts Payable/Cost of Goods Sold) * Number of Days in Period

DPO= ((5,000 + 9,000)/2)/105,600 * 365

DPO = 24.195 or 24 days

This means that on average, AT company takes approximately 24 days to pay its payables.

Lastly, with all the components in hand, let’s compute for the cash conversion cycle (CCC):

CCC = DIO + DSO – DPO

CCC = 22 + 25 -24

CCC = 23 days

This means that AT company’s cash conversion cycle for the year ended December 31, 2020 is 23 days.

Understanding the Cash Conversion Cycle

Okay. So now we have our cash conversion cycle for AT company (which is 23 days), but what does it mean?

On its own, it just simply tells us that AT company has a cash conversion cycle of 23 days.

But if we take a look at its components, that’s when we can make more interpretations.

Taking a closer at the individual components (DIO, DSO, and DPO) can help you assess in which areas the business can improve to have a lower cash conversion cycle.

Take for instance the DSO.

A high DSO would mean that collection is slow and inefficient.

Management can then use this to think of ways to improve the efficiency of collection. Or how about DPO.

If a business can have more leeway on its credit terms, it might be able to increase its DPO, which ultimately result in a lower CCC.

The cash conversion cycle tells us how fast and efficient a business can be in converting its invested cash into cash from sales.

If a business has a CCC of 15 days, it means that on average, it can expect a return on its invested cash every 15 days of operations.

Having a low CCC would be good for a business.

A business’s CCC should be compared with its previous periods CCC to see whether it is improving or not.

If the trend is downwards, that would mean that the business’s CCC is improving.

If the trend is upwards, management may need to review their operating activities, particularly inventory turnover, collection of receivables, and even the timing of payment of payables.

A business’s CCC should also be compared to the CCC of businesses operating within the same industry.

Doing so can tell a business whether or not it is doing well in managing its CCC.

Different industries will have different benchmarks for CCC.

It is to be expected that most businesses in the car manufacturing industry will have higher CCC than the businesses in the retail industry.

So while it may be good to compare your business’s CCC to other businesses, be sure that you compare it to the right businesses.

Some businesses even have negative CCC (mostly those involved with online retailing).

Online retailers have platforms where third-party sellers can sell their products.

These third-party sellers however don’t immediately receive payment upon sale but instead is based on the payment cycle of the online retailer (could be monthly, or threshold-based).

In addition, if a third-party seller maintains its inventory, then the online retailer won’t have to.

All of these result in a negative CCC.

Limitations of the Cash Conversion Cycle

As the computation for CCC involves computing for the efficiency of inventory conversion, businesses that don’t maintain inventory might not need it.

For example, a business that only offers services won’t need to maintain an inventory so it doesn’t have to compute for DIO, which is one of the components of CCC (though it can still compute for DSO and DPO, both informative financial ratios on their own).

Also, as mentioned above, CCC won’t give you too much insight into a business on its own.

For it to be fully effective, you need to compare it with previous periods’ CCC, or with the CCC of another business in the same industry.

You can also use it in conjunction with other ratios such as Return-on-Assets (ROA) and Return-on-Equity (ROE) to assess a business’s financial situation.

Ways to improve your cash conversion cycle

There are several ways to improve a business’s CCC. Take a closer look at its components: DIO, DSO, and DPO.

For example, you can improve your DIO by reviewing your manufacturing process and see if there are areas that can be improved upon.

Or if you’re in a retail business, studying and knowing when is the right time to restock, and what is the optimal amount of inventory to be kept could help in improving DIO.

As for DSO, management can review their credit terms and see if they’re just right or maybe they need adjusting.

Or maybe they can just remove credit sales (but that may result in lesser overall sales).

Or maybe they can devise a way to incentivize customers who can pay on time, or even earlier (e.g. 10% if paid within 10 days, 5% if within 25 days).

Handling DPO can be more delicate than handling the other two components though.

You cannot just simply delay payments and expect to get away with it without any harm to the business.

Doing so may damage the business’s relationship with its suppliers.

It is better to build rapport with your suppliers so that in your next purchases, you may be able to ask for more lax credit terms.

All in all, anything that can improve inventory management, collection of receivables, and timing of payment of payables will ultimately result in a better cash conversion cycle.

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

IRS.gov "Accounting Periods and Methods" Page 1 . September 1, 2021

Harvard.edu "Homing in on Cash Conversion Cycle" Page 1. September 1, 2021

Mit.edu "Working Capital and Cash Conversion Cycle" Page 1 . September 1, 2021