Basic EPS vs Diluted EPSDifferences You Need to Know Between the Two!

Earnings Per Share (EPS) vs. Diluted EPS: An Overview

One of the many analyses used by firms to measure profitability is the Earnings Per Share (EPS) and Diluted EPS.

In their computations, EPS only takes into consideration the common shares while all convertible securities are taken into account.

Earnings per share can be the basis of an entity’s performance in the market and can prove to be a good strategy when firms want to gain more investors when displaying an entity’s continued stability and positive economic impact.

Earnings Per Share (EPS)

There are two main types of shares: ordinary shares and preferred shares.

Earnings Per Share (EPS) is used to measure the profitability of a firm on a per-share basis.

A Preferred Share corresponds to a fixed percentage rate of earnings while an ordinary share receives the residual amount of dividends after deducting all other distributive shares including preferred shares.

Since preferred shareholders will receive a fixed percentage rate of the net income, Basic Earnings Per Share corresponds only to common shares.

When the number of shares increases due to a new share issue, the dilutive effect occurs because when more shares are issued, the number of outstanding shares increases and therefore decreases the EPS.

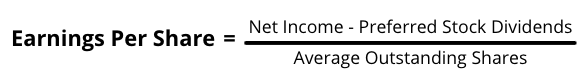

To compute the EPS, the preferred dividends are subtracted from the Net Income.

The difference is then divided by the average shares outstanding.

To show it as a formula:

Diluted Earnings Per Share

Diluted EPS is a measure of the quality of the Earnings Per Share (EPS) with the assumption that all convertible securities are taken into consideration.

Convertible securities include convertible debt, preferred shares, warrants, and equity options which are mainly employer-based.

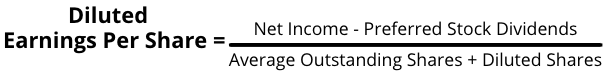

To compute the Diluted EPS, the preferred shares are subtracted from the Net Income and the difference is divided by the sum of the average outstanding shares and diluted shares (convertible securities).

Examples of EPS and Diluted EPS

ABC company provides the following information for the current year:

| Net Income | $8,500,000.00 |

| Dividends Paid | $0.00 |

| Average Outstanding Shares | $2,000,000.00 |

Based on the above, the EPS can be computed as:

If ABC Company also has convertible preferred shares that can be converted to $300,000 common shares and decide to offer employee stock options which can be converted to $250,000 common shares, the Diluted EPS will be computed as:

Diluted EPS tends to be less than EPS when there are convertible securities which increase the divisor in the Diluted EPS formula.

Is EPS Better Than Diluted EPS?

They are both important considering the given equity instruments that the entity possesses.

In understanding the profitability of a firm, the EPS is an important financial measure.

However, since companies have convertible securities, the Diluted EPS offers a more comprehensive view of a company’s profitability per share.

Why Are Diluted Earnings Per Share Important?

Computing the diluted EPS is a more accurate basis for financial measures because it considers shares that will become outstanding in the future.

When convertible securities are included in the computation, it dilutes the shares and consequently dilutes the overall profits resulting in lower per-share profitability.

What does a higher EPS indicate?

A higher EPS indicates that an entity’s operation is profitable.

Each shareholder is gaining much more from their investments.

However, an investor must also check historical EPS data and future EPS projections before making an important investment decision.

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

University of Minnesota "16.5 The Computation of Earnings per Share" Page 1 . April 20, 2022

Ohio University "Share Based Compensation and Earnings per Share" Page 1 - 8. April 20, 2022