AMT – Alternative Minimum TaxDefinition & Who Has to Pay this

In this article, we’ll discuss how to compute your Alternative Minimum Tax (AMT), what the Alternative Minimum Tax is and how to determine the individuals subjected to pay it.

The Definition of Alternative Minimum Tax (AMT)

To guarantee that certain taxpayers pay at least a minimum amount of their income tax, the Alternative Minimum Tax (AMT) was implemented which puts the taxpayer in the position to comply with various alternative minimum tax guidelines.

One of the guidelines that have to be followed involves the increase in the taxpayers’ income tax liability by putting a cap on their deductions, exclusions, credits, and other forms of tax breaks.

This increase in tax liability is computed by using the rates of 26 percent or 28 percent.

The Individuals Subjected to Pay the Alternative Minimum Tax (AMT)

Individuals whose earnings exceed the yearly Alternative Minimum Tax (AMT) exemption amounts, are subjected to pay the AMT.

Naturally, Alternative Minimum Taxpayers are workers who are considered as high earning.

Consequently, they have to compute their income tax twice – one that follows the standard tax guidelines and the other which follows the guidelines under AMT – whichever yields the higher amount is the income tax liability to be paid.

The Computation of the Alternative Minimum Tax (AMT)

The construction of the alternative minimum tax is implemented parallel to the Standard Tax System though there were the usual tax breaks which were removed from the AMT and this is what differentiates the Alternative Minimum Tax (AMT) from the Standard Tax System. Other than that, the Standard Tax System and the Alternative Minimum Tax perform quite similarly.

To compute for your AMT, the following guidelines are used:

- You have to first compute for your AMT taxable income. IRS Form 6251 provides information regarding the tax exclusions and tax deductions allowable for calculating your AMT Taxable Income.

- Deduct your AMT exemption amount from your AMT Taxable Income. For details regarding the exempted amount, please refer to the tables below.

2020 Alternative Minimum Tax (AMT) Exemption

| CRITERIA | SINGLE/ HEAD OF HOUSEHOLD | MARRIED FILING JOINTLY/ SURVIVING SPOUSE | MARRIED FILING SEPARATELY |

| EXEMPTED AMOUNT | $ 72,900.00 | $ 113,400.00 | $ 56,700.00 |

| 28 PERCENT THRESHOLD | $ 197,900.00 | $ 197,900.00 | $ 98,950.00 |

| THRESHOLD PHASEOUT AMOUNT | $ 518,400.00 | $ 1,036,800.00 | $ 518,400.00 |

| Some taxpayers under 24 are exempted up to their earnings plus $ 7,900.00. | |||

2021 Alternative Minimum Tax (AMT) Exemption

| CRITERIA | SINGLE/ HEAD OF HOUSEHOLD | MARRIED FILING JOINTLY/ SURVIVING SPOUSE | MARRIED FILING SEPARATELY |

| EXEMPTED AMOUNT | $ 73,600.00 | $ 114,600.00 | $ 57,300.00 |

| 28 PERCENT THRESHOLD | $ 199,900.00 | $ 199,900.00 | $ 99,950.00 |

| THRESHOLD PHASEOUT AMOUNT | $ 523,600.00 | $ 1,047,200.00 | $ 523,600.00 |

| Some taxpayers under 24 are exempted up to their earnings plus $ 7,900.00. | |||

- The difference of your AMT taxable income and your alternative minimum tax exemption is then multiplied by the applicable alternative minimum tax rate. As mentioned earlier, alternative minimum tax has two tax rates – 26% and 28%. The appropriate rate to use depends upon the amount of your AMT Taxable Income. Again, IRS Form 6251 provides additional information regarding this.

- If you are qualified, you can deduct your Alternative Minimum Tax Foreign Tax Credit from your AMT Taxable Income. The amount left after doing so is your AMT Income Tax.

- Whichever is higher between your Regular Income Tax and AMT Income Tax is the amount you need to pay for. Simply speaking, it is this regulation that identifies who the Alternative Minimum Taxpayers are.

The Loss of Certain Tax Breaks under the Alternative Minimum Tax (AMT)

Usually, taxpayers will find different tax concessions to minimize their taxable income.

Unfortunately, some of the deductions, exclusions, and credits cannot be utilized under the Alternative Minimum Tax.

One of the losses of certain tax breaks under the alternative minimum tax is the property tax deduction which is now under the state and local tax deduction law.

Another thing to consider is that under the alternative minimum tax, a variety of business items are cut down from allowable tax deductions.

Long term capital gains and specific dividends will increase your earnings under the Alternative Minimum Tax structure.

Consequently, investors will be required to compute for their alternative minimum tax when filing their taxes.

Am I Supposed to Pay Alternative Minimum Income Tax (AMT)?

Upon filing for your tax returns, if the calculations show that you have to pay an alternative minimum income tax, then frankly put, you will have to pay for it.

There is not much that can be done to escape the obligation of paying alternative minimum tax.

Although being aware of your finances and if you could be qualified to pay for alternative minimum tax in the future will help you prepare financially for it.

If you suspect you may be obligated to pay the alternative minimum tax, consulting with a tax expert will be beneficial to you whether it comes to the additional paperwork needed, the reduction of the alternative minimum tax or the overall avoidance of the AMT.

One way for you to decrease your declared total earnings is to monitor your capital gains for the long term. Another way to get this done is to minimize your declared total earnings by increasing your contributions to a 401(k) or an Individual Retirement Account (IRA).

Seeking advice from a tax expert is very helpful and is the recommended thing to do. In addition to that, the burden of the extra paperwork will not fall into your hands.

Do you still find all of this so overwhelming?

Well today is your day.

There is readily available software out in the market today that does the math for you.

All you have to do is input the information needed then the program will provide you a detailed computation of both tax systems – the regular tax system which uses Form 1040 and the Alternative Minimum Tax system which uses Form 6251.

The History of Alternative Minimum Income Tax (AMT)

Throughout 1969 during the Vietnam War, the American congress quickly ordained an additional minimum tax obliging individuals to pay that additional minimum tax along with their regular income tax.

The enactment focuses on specific revenues, just like the capital gains earned through the sale of an asset that has increased in value over a set holding period which also happens to be the enactment’s most preferred income.

Part of the specific revenues focused on are those that are either slightly taxed or not at all under the standard income tax.

This enactment happened as there were about 155 taxpayers earning more than $200,000 who have not paid their respective federal income tax in the year 1966 reported by Treasury Secretary Joseph W. Barr which became a topic of discussion and has caused great distress to the members of Congress considering there was still an ongoing war.

Originally part of the add on tax system, preferred earnings along with capital gains were transferred to the Alternative Minimum Tax structure.

To perform as a taxation structure that is in conjunction with the original add on tax system, the alternative minimum tax was constituted in the year 1979. By 1983, add on tax was later revoked by the Congress.

The Economic Growth and Tax Relief Reconciliation Act was legislated in 2001 which provided temporary alleviation to less than 1 million individuals regarding their Alternative Minimum Tax as they have been subjected to pay both the original minimum tax and the alternative minimum tax yearly during the late 1990s.

Despite that, this law has also considerably lessened the taxpayer’s regular income tax obligation.

At the time being, raising the alternative minimum tax exemption amount was a way to mend the Alternative Minimum Tax as constitutions were frequently made, often at the last minute for the past ten years with projections for this continuing until the next ten years.

Despite the frequent amendments made to stop the Alternative Minimum Tax from increasing alarmingly, these changes did not prepare the taxpayers from what could have happened.

Below is a table that demonstrates the number of taxpayers affected through the years 1970 until 2030.

Source of Data: Urban-Brookings Tax Policy Center Microsimulation Model (versions 0304-3, 0308-4, 1006-1, 0613-1, 0319-2); Harvey and Tempalski (1997); private communication with Jerry Tempalski; SOI Division of the Internal Revenue Service.

Chart Image Source: https://www.taxpolicycenter.org/briefing-book/what-amt

Keep in Mind: This data analysis is inclusive of taxpayers with AMT Liability based on Form 6251, lost credits, and diminished tax deductions for the years 2001-2030 and exclusive of specific taxes from individuals depending on other taxpayers.

As you can see in figure 1, for the last 10 years, individuals affected by the Alternative Minimum Tax have been continuously growing.

This happened due to the fact that the standard income tax was tabulated for inflation whereas Alternative Minimum Tax wasn’t.

Then, there is also the fact that considerable deductions to the regular income tax was legislated by the Congress.

With that being said, a stable Alternative Minimum Tax was constituted by the American Taxpayer Relief Act of 2012 by instituting a bigger Alternative Minimum Tax exemption amount, tabulating the limitations of Alternative Minimum Tax against inflation, and authorizing certain tax credits for Alternative Minimum Tax.

Subsequently, as seen in figure 1 during the year 2013, AMT taxpayers have decreased by 500,000 compared to 2012 and by 2017, the number of AMT taxpayers has slowly increased by 1.1 million compared to 2013.

Some of the stipulations which the 2017 Tax Cuts and Job Acts (TCJA) institutionalized that have seriously diminished the effects of the Alternative Minimum Tax are as follows:

- increasing the Alternative Minimum Tax exemption

- extensively raising the income commencing the phase out threshold

- reducing certain AMT tax credits and tax breaks such as the personal exemptions

- the state and local tax deductions which is essentially the property tax deduction

- 2 percent deduction of the adjusted gross income (AGI) referring to the miscellaneous itemized deductions

Accordingly, Alternative Minimum Taxpayers will fall to 200,000 and shall remain strictly consistent until 2025 as determined by the Tax Policy Center (TPC).

In 2026 and with the exception of rulings from the Congress, the Alternative Minimum Tax shall make a significant return, causing distress to 6.7 million taxpayers which is expected to increase up to 7.6 million in 2030.

By the end of 2025, the AMT stipulations in addition to the other individual income tax legislations in the Tax Cuts and Jobs Act of 2017 (TCJA) shall expire.

The Parameters of Alternative Minimum Income Tax (AMT)

To obtain the amount of your Alternative Minimum Tax obligation you must first compute your regular income tax.

From there on you are required to add back certain Alternative Minimum Tax “preference items” to your taxable income from which you will deduct the Alternative Minimum Tax exemption amount then multiply that amount by the appropriate rate. If there is any surplus, the amount that is considered as a surplus is your Alternative Minimum Tax payable.

This amount will need to be compared with your regular income tax payables so you will know which obligation is higher and will therefore be the obligation that you will have to pay

The state and local tax deductions, encompassing 62 percent of all the preferences during 2012 reported by the US Department of Treasury; the personal exemptions, comprising 21 percent of all the itemized preferences; and the miscellaneous business expense deductions, which covers 9.5 percent of all the itemized preferences are some of the bigger Alternative Minimum Tax preference items prior to the sanction of the Tax Cuts and Jobs Act.

The specific Alternative Minimum Tax guidelines regarding the net operating losses standard deduction, depreciation, passive losses, and other preferences like the regular deductions will be essential during 2025 since the personal exemptions and the miscellaneous business deductions were momentarily revoked by the Tax Cuts and Jobs Act which ha alsos put a limit up to $10,000 for the state and local tax deduction.

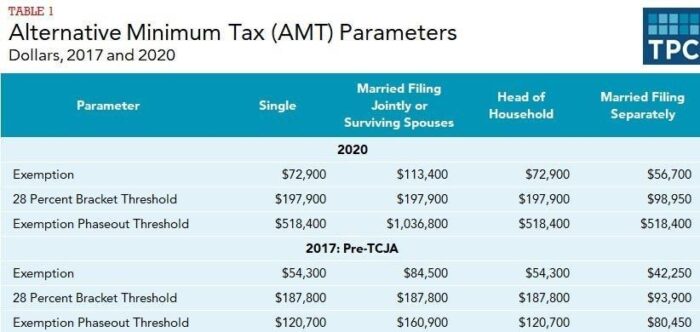

During 2017, the exemption amount for the married couples who are jointly filing their tax was $84,500 which was increased by $28,900 amounting to $113,400 last 2020.

As for the single and the heads of households, their exemption amount started at $54,300 which was increased by $18,600 amounting to $72,900 last 2020.

As mentioned previously, the Alternative Minimum Tax rate structure is composed of two rates – 26% and 28%. Below is a table with the parameters of the Alternative Minimum Tax in dollars for the years 2017 to 2020:

Source of Data: Internal Revenue Service. Revenue Procedure 2019-44, October 2019-44.

Table Image Source: https://www.taxpolicycenter.org/briefing-book/what-amt

Keep in Mind: All parameters are tabulated yearly for inflation.

Based on the table, during 2017, single status taxpayers, married couples filing jointly, and heads of households earning $187,800 as well as married couples who are separately filing earning $93,900 are taxed at a 26 percent rate.

Respectively, any earnings beyond the aforementioned are already taxed at a 28 percent rate. Correspondingly, their exemption amount starts to eliminate at $120,700 for singles and heads of households, $187,800 for married couples filing jointly, and $80,450 for married couples filing separately.

During 2020 amounts increased for the 26 percent category by $10,100 amounting to $197,900 for singles, married couples filing jointly, and heads of households; and $5,050 amounting to $98,950 for married couples filing separately.

As for the exemption phase out category, amounts skyrocketed by $397,900 for the singles and heads of households, $437,950 for married couples who are filing separately, and $875,900 for married couples jointly filing.

The Alternative Minimum Tax was able to generate a constructive tax rate of about 35 percent which is 125 percent rate of 28 percent rate since the exemption amount starts to eliminate at a 25 percent rate (all numbers shown in the table are represented in dollars).

Using the chain weighted consumer price index, the 2020 amounts have been yearly tabulated for inflation.