Accounts Receivable FactoringExplained with Journal Entry Examples

What is Accounts Receivable Factoring?

Accounts Receivable Factoring is the process of a company selling or transferring their receivables to financing companies that specializes in buying accounts receivable, referred to as the Factor.

The other terms used for Accounts Receivable Factoring are Accounts Receivable Financing and Invoice Factoring.

Understanding How Accounts Receivable Factoring Works

In Accounts Receivable Factoring, the receivables that a company has are sold or transferred to a Factor.

The Factor then collects the payments from the company’s customers.

A lot of companies have opted to use factoring rather than spend the time and effort collecting the payments on credit sales to their customers.

In doing so, they are immediately able to build their cash flow rather than tie their capital to accounts receivable.

In addition to that, the risk of default is also transferred to Factors since they would have already received the payment from them for the invoices.

How Accounts Receivables are Priced by Factoring Companies

Factors charge an amount called a Factor Fee for their purchase of a company’s accounts receivables.

The fee is based on a percentage that is charged against the total receivable and changes depending on the industry of the company, the creditworthiness of the customer, average days outstanding of the invoices, and the volume of the invoices.

Another important consideration that can affect the factor fee is whether the factoring is with recourse or without recourse.

A with recourse factoring means that the Factor can still come after the company who sold the receivables should their customers default in their payment.

Factoring without recourse means that the Factor assumes all the risk related to the invoices including the credit risk.

The factor fee is lower for receivables sold with recourse than it is for without recourse.

Recourse Factoring and Non-Recourse Factoring

Invoice factoring can be of two types: Without Recourse and With Recourse.

Transfer without recourse means that the Factor assumes all of the risks attached to the invoices including the risk of the invoices defaulting.

The company who sold the receivable will have no liability towards the Factor should its customers default on their payments.

On the other hand, transfer with recourse means that should the customers of the company who sold the invoices default, the Factor can demand payment from the company for the invoices that remained unpaid.

Examples of Accounts Receivable Factoring

Transfer Without Recourse

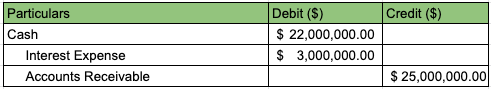

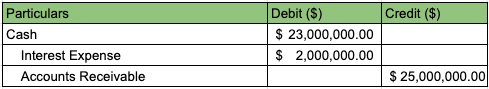

Company ABC has total outstanding invoices of $25,000,000 and decided to transfer it to a factoring company for $22,000,000.

When Company ABC receives the amount from the factoring company, this journal entry will be posted in their books:

Transfer With Recourse

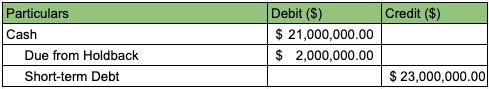

Company ABC transferred their total receivables of $25,000,000 with recourse to a factoring company for a total proceeds of $23,000,000 with a $2,000,000 holdback.

The holdback amount is the payment that the company pays the factor in case of non-payment.

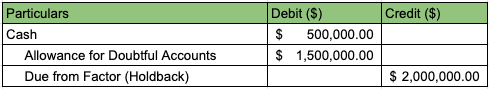

A few months later, the Factor collected $23,500,000 with $1,500,000 that still remained uncollectible.

To record the transfer of the receivables, the journal entry to be recorded is:

The journal entry to record the receipt of payments from the total receivables would be:

FundsNet requires Contributors, Writers and Authors to use Primary Sources to source and cite their work. These Sources include White Papers, Government Information & Data, Original Reporting and Interviews from Industry Experts. Reputable Publishers are also sourced and cited where appropriate. Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

Penn State "The Role of Factoring for Financing Small and Medium Enterprises " White Paper. February 2, 2022

Cornell Law School "Factoring" Page 1 . February 2, 2022

Walden University "The Effects of Using Invoice Factoring to Fund a Small Business" White Paper. February 2, 2022